Question: please explain could you please answer this question instead as the rfr was not given for the precious question Suppose an asset has a beta

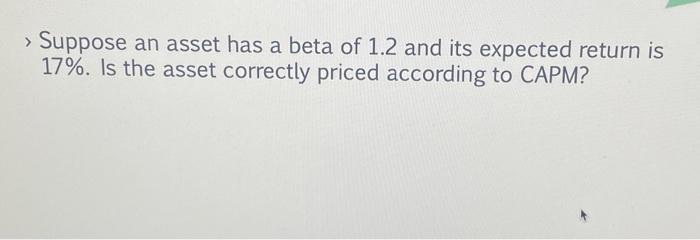

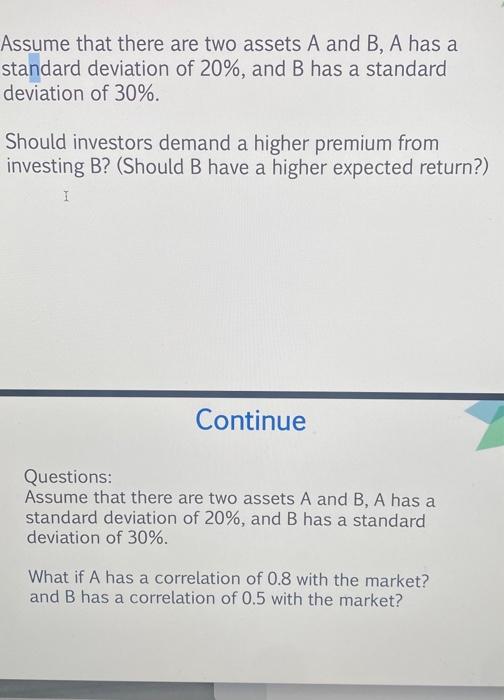

Suppose an asset has a beta of 1.2 and its expected return is 17%. Is the asset correctly priced according to CAPM? Assume that there are two assets A and B,A has a standard deviation of 20%, and B has a standard deviation of 30%. Should investors demand a higher premium from investing B? (Should B have a higher expected return?) Continue Questions: Assume that there are two assets A and B,A has a standard deviation of 20%, and B has a standard deviation of 30%. What if A has a correlation of 0.8 with the market? and B has a correlation of 0.5 with the market? Suppose an asset has a beta of 1.2 and its expected return is 17%. Is the asset correctly priced according to CAPM? Assume that there are two assets A and B,A has a standard deviation of 20%, and B has a standard deviation of 30%. Should investors demand a higher premium from investing B? (Should B have a higher expected return?) Continue Questions: Assume that there are two assets A and B,A has a standard deviation of 20%, and B has a standard deviation of 30%. What if A has a correlation of 0.8 with the market? and B has a correlation of 0.5 with the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts