Question: Please explain: Date of issue Amount ofissue Maturity date and currency denomination (most likely in U.S.dollars) Face value Annualcoupon Is the bond callable, puttable orconvertible?

Please explain:

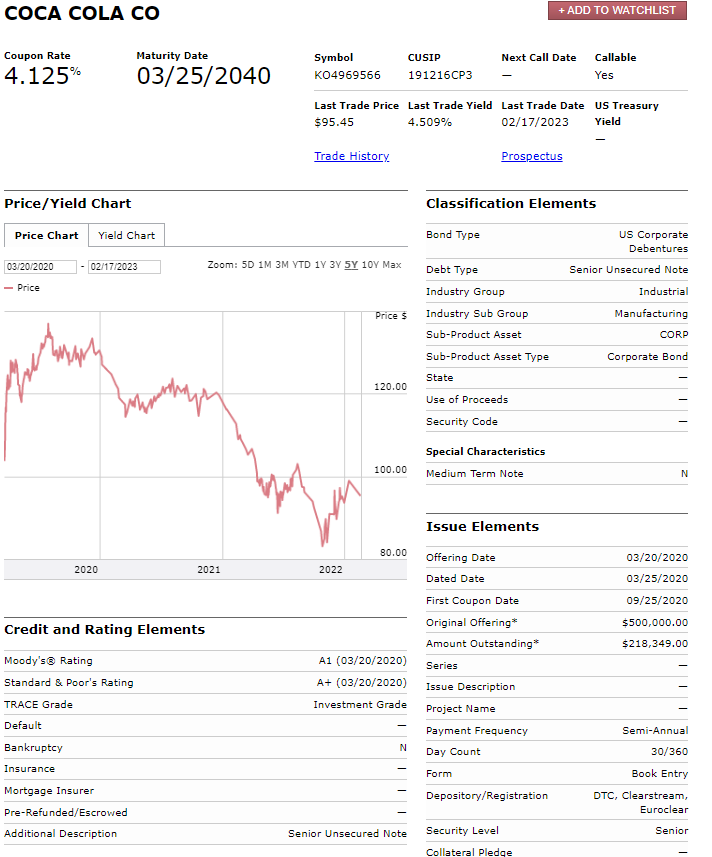

- Date of issue

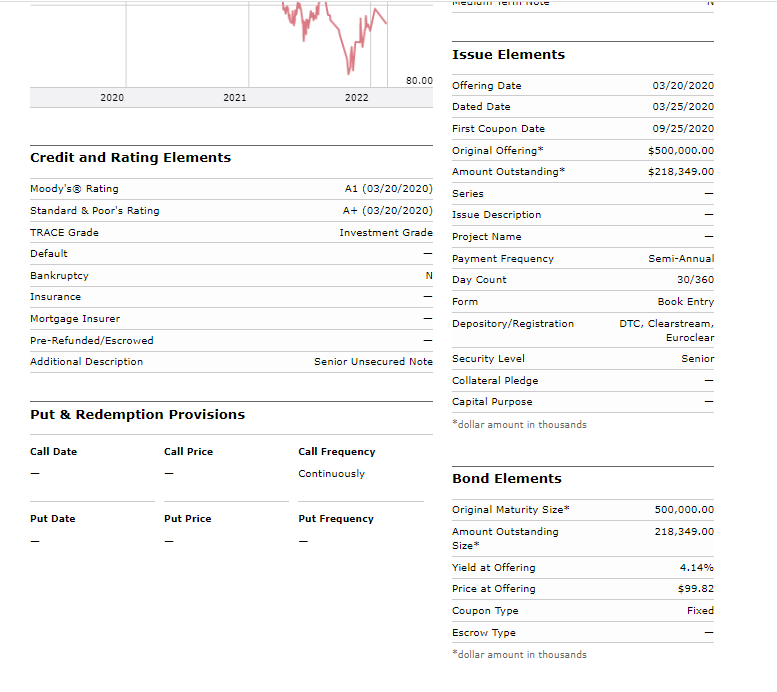

- Amount ofissue

- Maturity date and currency denomination (most likely in U.S.dollars)

- Face value

- Annualcoupon

- Is the bond callable, puttable orconvertible?

- Yield, current price (you can verify this using the bond price equation) and rating

- Any additional information

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock