Question: Please explain each equation used. Thank you Multiple Choice Question 109 Hogan Industries had the following inventory transactions occur during 2017: Feb. 1, 2017 Purchase

Please explain each equation used. Thank you

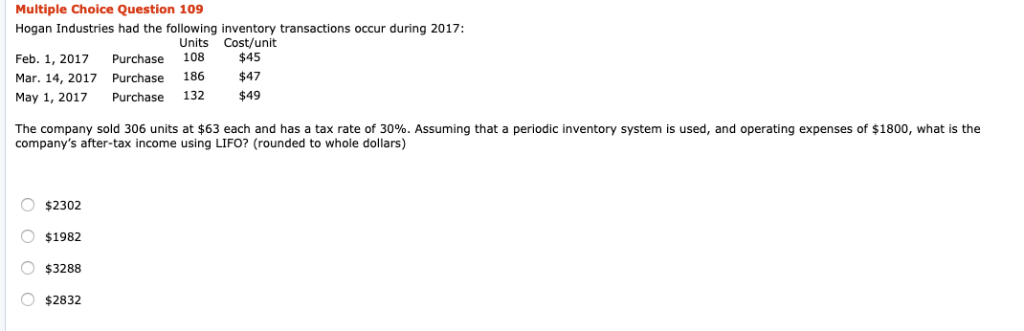

Multiple Choice Question 109 Hogan Industries had the following inventory transactions occur during 2017: Feb. 1, 2017 Purchase 108 $45 Mar. 14, 2017 Purchase 186 $47 May 1, 2017 Purchase 132 $49 Units Cost/unit The com pany sold 306 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, and operating expenses of $1800, what is the company's after-tax income using LIFO? (rounded to whole dollars) $2302 $1982 $3288 $2832

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts