Question: Please explain each question step by step, thanks enough info 1. Bond prices and their sensitivity to interest rates Calculate the prices of the following

Please explain each question step by step, thanks enough info

Please explain each question step by step, thanks enough info

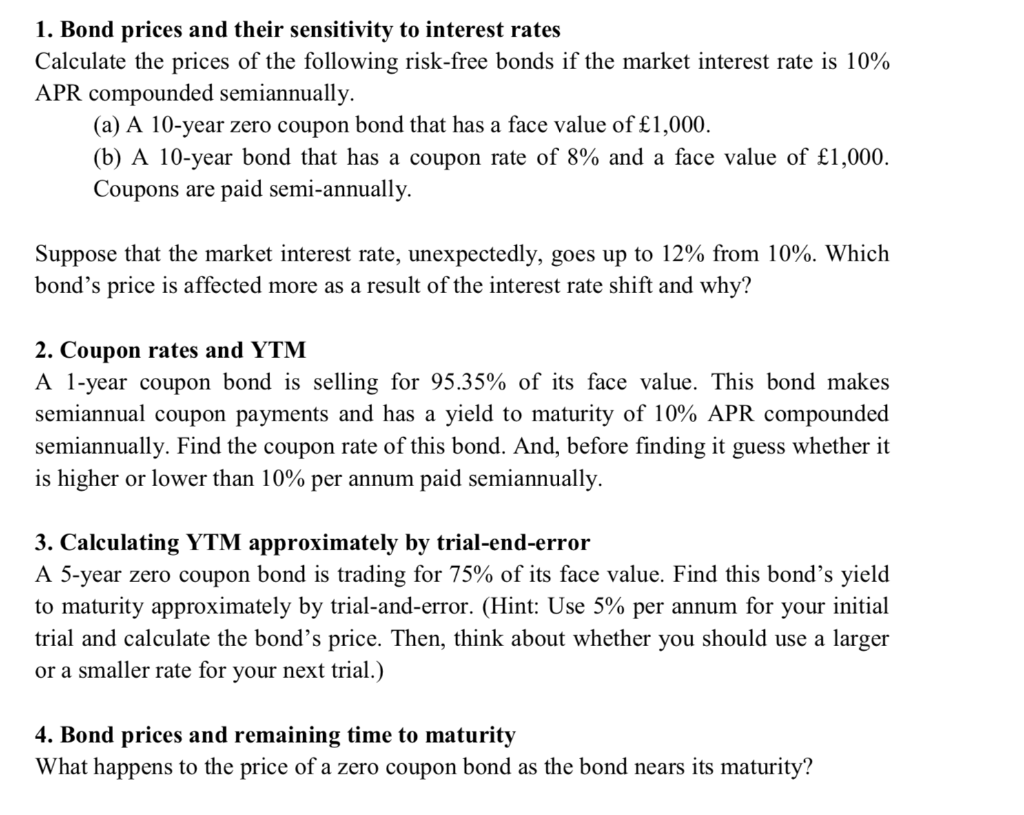

1. Bond prices and their sensitivity to interest rates Calculate the prices of the following risk-free bonds if the market interest rate is 10% APR compounded semiannually. (a) A 10-year zero coupon bond that has a face value of 1,000. (b) A 10-year bond that has a coupon rate of 8% and a face value of 1,000. Coupons are paid semi-annually. Suppose that the market interest rate, unexpectedly, goes up to 12% from 10%. Which bond's price is affected more as a result of the interest rate shift and why? 2. Coupon rates and YTM A 1-year coupon bond is selling for 95.35% of its face value. This bond makes semiannual coupon payments and has a yield to maturity of 10% APR compounded semiannually. Find the coupon rate of this bond. And, before finding it guess whether it is higher or lower than 10% per annum paid semiannually. 3. Calculating YTM approximately by trial-end-error A 5-year zero coupon bond is trading for 75% of its face value. Find this bond's yield to maturity approximately by trial-and-error. (Hint: Use 5% per annum for trial and calculate the bond's price. Then, think about whether you should use a larger or a smaller rate for your next trial.) your initial 4. Bond prices and remaining time to maturity What happens to the price of a zero coupon bond as the bond nears its maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts