Question: (PLEASE EXPLAIN EACH STEP, AND HOW IT WAS CALCULATED. THANK YOU IN ADVANCE) You are trying to estimate a price per share on an initial

(PLEASE EXPLAIN EACH STEP, AND HOW IT WAS CALCULATED. THANK YOU IN ADVANCE)

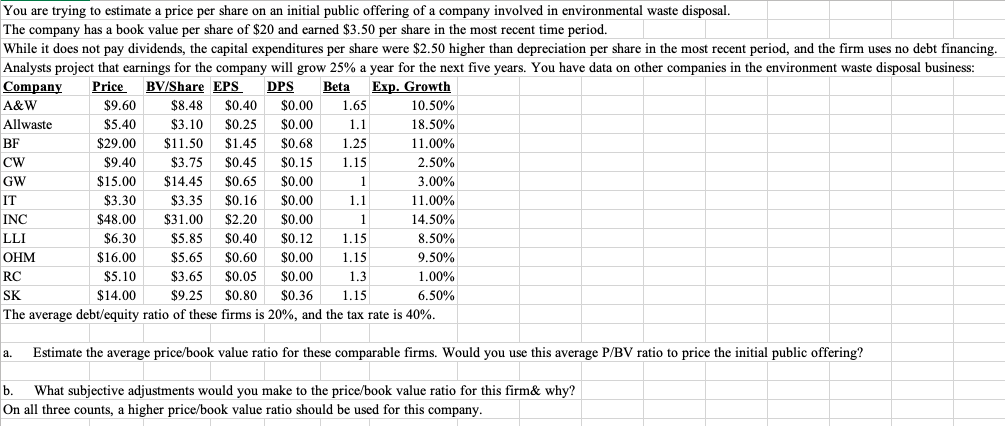

You are trying to estimate a price per share on an initial public offering of a company involved in environmental waste disposal. The company has a book value per share of $20 and earned $3.50 per share in the most recent time period. While it does not pay dividends, the capital expenditures per share were $2.50 higher than depreciation per share in the most recent period, and the firm uses no debt financing. Analysts project that earnings for the company will grow 25% a year for the next five years. You have data on other companies in the environment waste disposal business: Company Price BV/Share EPS DPS Beta Exp. Growth A&W $9.60 $8.48 $0.40 $0.00 1.65 10.50% Allwaste $5.40 $3.10 $0.25 $0.00 1.1 18.50% BF $29.00 $11.50 $1.45 $0.68 1.25 11.00% $9.40 $3.75 $0.45 $0.15 1.15 2.50% GW $15.00 $14.45 $0.65 $0.00 1 3.00% IT $3.30 $3.35 $0.16 $0.00 11.00% INC $48.00 $31.00 $2.20 $0.00 1 14.50% LLI $6.30 $5.85 $0.40 $0.12 1.15 8.50% OHM $16.00 $5.65 $0.60 $0.00 1.15 9.50% RC $5.10 $3.65 $0.05 $0.00 1.3 1.00% SK $14.00 $9.25 $0.80 $0.36 1.15 6.50% The average debt/equity ratio of these firms is 20%, and the tax rate is 40%. CW 1.1 6. a. Estimate the average price/book value ratio for these comparable firms. Would you use this average P/BV ratio to price the initial public offering? b. What subjective adjustments would you make to the price/book value ratio for this firm& why? On all three counts, a higher price/book value ratio should be used for this company. You are trying to estimate a price per share on an initial public offering of a company involved in environmental waste disposal. The company has a book value per share of $20 and earned $3.50 per share in the most recent time period. While it does not pay dividends, the capital expenditures per share were $2.50 higher than depreciation per share in the most recent period, and the firm uses no debt financing. Analysts project that earnings for the company will grow 25% a year for the next five years. You have data on other companies in the environment waste disposal business: Company Price BV/Share EPS DPS Beta Exp. Growth A&W $9.60 $8.48 $0.40 $0.00 1.65 10.50% Allwaste $5.40 $3.10 $0.25 $0.00 1.1 18.50% BF $29.00 $11.50 $1.45 $0.68 1.25 11.00% $9.40 $3.75 $0.45 $0.15 1.15 2.50% GW $15.00 $14.45 $0.65 $0.00 1 3.00% IT $3.30 $3.35 $0.16 $0.00 11.00% INC $48.00 $31.00 $2.20 $0.00 1 14.50% LLI $6.30 $5.85 $0.40 $0.12 1.15 8.50% OHM $16.00 $5.65 $0.60 $0.00 1.15 9.50% RC $5.10 $3.65 $0.05 $0.00 1.3 1.00% SK $14.00 $9.25 $0.80 $0.36 1.15 6.50% The average debt/equity ratio of these firms is 20%, and the tax rate is 40%. CW 1.1 6. a. Estimate the average price/book value ratio for these comparable firms. Would you use this average P/BV ratio to price the initial public offering? b. What subjective adjustments would you make to the price/book value ratio for this firm& why? On all three counts, a higher price/book value ratio should be used for this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts