Question: (Please explain each step, and how it was calculated. Thank you in advance) You are attempting to structure a debt issue for Eaton Corporation, a

(Please explain each step, and how it was calculated. Thank you in advance)

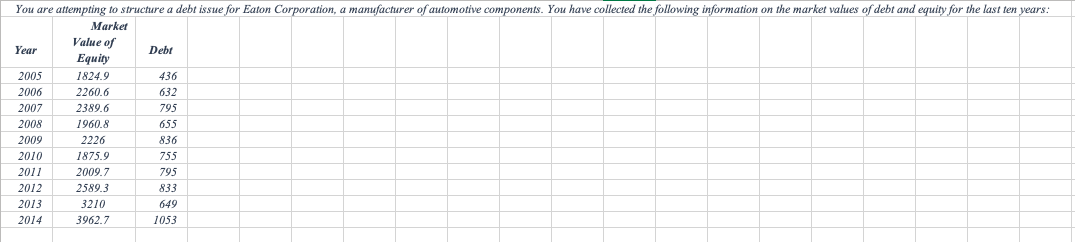

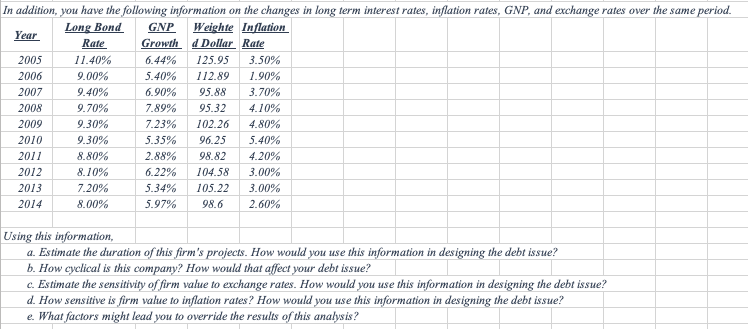

You are attempting to structure a debt issue for Eaton Corporation, a manufacturer of automotive components. You have collected the following information on the market values of debt and equity for the last ten years: Market Value of Year Debt Equity 2005 1824.9 436 2006 2260.6 632 2007 2389.6 795 2008 1960.8 655 2009 2226 836 2010 1875.9 755 2011 2009.7 795 2012 2589.3 833 2013 3210 649 2014 3962.7 1053 In addition, you have the following information on the changes in long term interest rates, inflation rates, GNP, and exchange rates over the same period. Long Bond GNP Weighte Inflation Year Rate Growth d Dollar Rate 2005 11.40% 6.44% 125.95 3.50% 2006 9.00% 5.40% 112.89 1.90% 2007 9.40% 6.90% 95.88 3.70% 2008 9.70% 7.89% 95.32 4.10% 2009 9.30% 7.23% 102.26 4.80% 2010 9.30% 5.35% 96.25 5.40% 2011 8.80% 2.88% 98.82 4.20% 2012 8.10% 6.22% 104.58 3.00% 2013 7.20% 5.34% 105.22 3.00% 2014 8.00% 5.97% 98.6 2.60% Using this information, a. Estimate the duration of this firm's projects. How would you use this information in designing the debt issue? b. How cyclical is this company? How would that affect your debt issue? c. Estimate the sensitivity of firm value to exchange rates. How would you use this information in designing the debt issue? d. How sensitive is firm value to inflation rates? How would you use this information in designing the debt issue? e. What factors might lead you to override the results of this analysis? You are attempting to structure a debt issue for Eaton Corporation, a manufacturer of automotive components. You have collected the following information on the market values of debt and equity for the last ten years: Market Value of Year Debt Equity 2005 1824.9 436 2006 2260.6 632 2007 2389.6 795 2008 1960.8 655 2009 2226 836 2010 1875.9 755 2011 2009.7 795 2012 2589.3 833 2013 3210 649 2014 3962.7 1053 In addition, you have the following information on the changes in long term interest rates, inflation rates, GNP, and exchange rates over the same period. Long Bond GNP Weighte Inflation Year Rate Growth d Dollar Rate 2005 11.40% 6.44% 125.95 3.50% 2006 9.00% 5.40% 112.89 1.90% 2007 9.40% 6.90% 95.88 3.70% 2008 9.70% 7.89% 95.32 4.10% 2009 9.30% 7.23% 102.26 4.80% 2010 9.30% 5.35% 96.25 5.40% 2011 8.80% 2.88% 98.82 4.20% 2012 8.10% 6.22% 104.58 3.00% 2013 7.20% 5.34% 105.22 3.00% 2014 8.00% 5.97% 98.6 2.60% Using this information, a. Estimate the duration of this firm's projects. How would you use this information in designing the debt issue? b. How cyclical is this company? How would that affect your debt issue? c. Estimate the sensitivity of firm value to exchange rates. How would you use this information in designing the debt issue? d. How sensitive is firm value to inflation rates? How would you use this information in designing the debt issue? e. What factors might lead you to override the results of this analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts