Question: please explain each step and use the worksheet format. thank you The Scooby Corporation has an opportunity to sell SCOOBY SNACKS. Scoobert, (a.k.a. Scooby) the

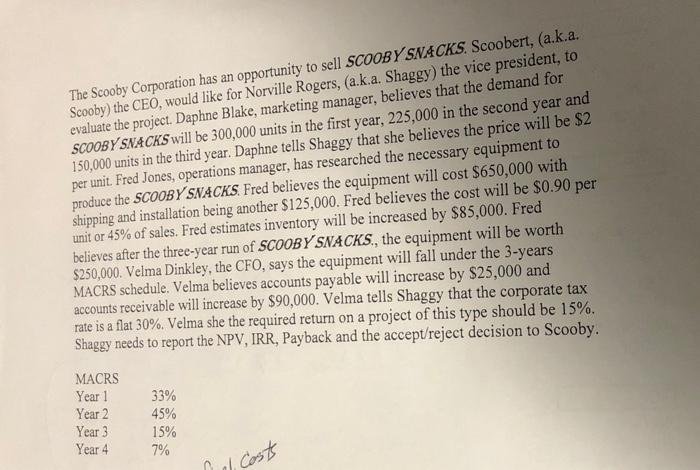

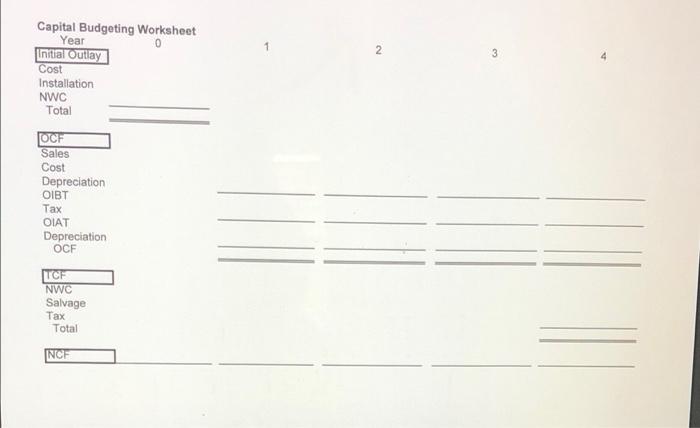

The Scooby Corporation has an opportunity to sell SCOOBY SNACKS. Scoobert, (a.k.a. Scooby) the CEO, would like for Norville Rogers, (a.k.a. Shaggy) the vice president, to evaluate the project. Daphne Blake, marketing manager, believes that the demand for SCOOBY SNACKS will be 300,000 units in the first year, 225,000 in the second year and 150,000 units in the third year. Daphne tells Shaggy that she believes the price will be $2 per unit. Fred Jones, operations manager, has researched the necessary equipment to produce the SCOOBY SNACKS. Fred believes the equipment will cost $650,000 with shipping and installation being another $125,000. Fred believes the cost will be $0.90 per unit or 45% of sales. Fred estimates inventory will be increased by $85,000. Fred believes after the three-year run of SCOOBY SNACKS., the equipment will be worth $250,000. Velma Dinkley, the CFO, says the equipment will fall under the 3-years MACRS schedule. Velma believes accounts payable will increase by $25,000 and accounts receivable will increase by $90,000. Velma tells Shaggy that the corporate tax rate is a flat 30%. Velma she the required return on a project of this type should be 15%. Shaggy needs to report the NPV, IRR, Payback and the accept/reject decision to Scooby MACRS Year 1 Year 2 Year 3 Year 4 33% 45% 15% 7% al costs 2 3 Capital Budgeting Worksheet Year Initial Outlay Cost Installation NWC Total OCF Sales Cost Depreciation OIBT Tax OIAT Depreciation OCF TCF NWC Salvage Tax Total INCH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts