Question: please explain each step and use the worksheet format. thank you The Howell Corporation would like to turn the island into a resort. Thurston Howell

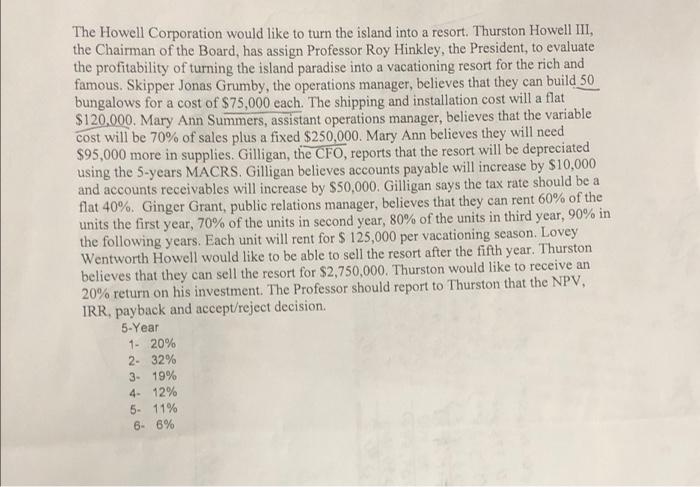

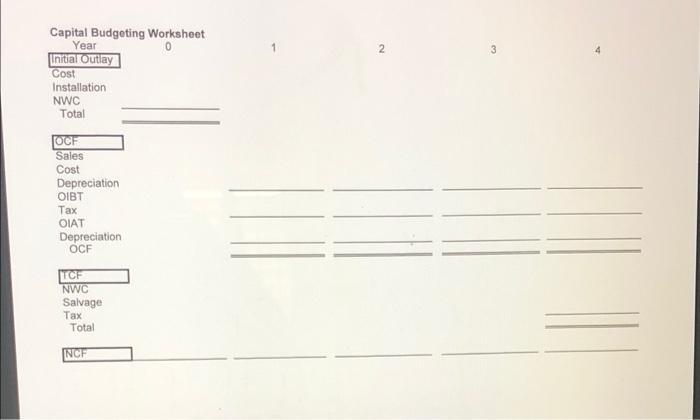

The Howell Corporation would like to turn the island into a resort. Thurston Howell III, the Chairman of the Board, has assign Professor Roy Hinkley, the President, to evaluate the profitability of turning the island paradise into a vacationing resort for the rich and famous. Skipper Jonas Grumby, the operations manager, believes that they can build 50 bungalows for a cost of $75,000 each. The shipping and installation cost will a flat $120.000. Mary Ann Summers, assistant operations manager, believes that the variable cost will be 70% of sales plus a fixed $250,000. Mary Ann believes they will need $95,000 more in supplies. Gilligan, the CFO, reports that the resort will be depreciated using the 5-years MACRS. Gilligan believes accounts payable will increase by $10,000 and accounts receivables will increase by $50,000. Gilligan says the tax rate should be a flat 40%. Ginger Grant, public relations manager, believes that they can rent 60% of the units the first year, 70% of the units in second year, 80% of the units in third year, 90% in the following years. Each unit will rent for S 125,000 per vacationing season. Lovey Wentworth Howell would like to be able to sell the resort after the fifth year. Thurston believes that they can sell the resort for $2,750,000. Thurston would like to receive an 20% return on his investment. The Professor should report to Thurston that the NPV, IRR, payback and accept/reject decision 5-Year 1- 20% 2- 32% 3- 19% 4. 12% 5. 11% 6- 6% 2 3 4 Capital Budgeting Worksheet Year 0 Initial Outlay Cost Installation NWC Total OCH Sales Cost Depreciation OIBT Tax OIAT Depreciation OCF TCF NWC Salvage Tax Total INCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts