Question: Please explain each step in easy details. F the first year PR 14-1A Effect of financing on earnings per share Three different plans for financi

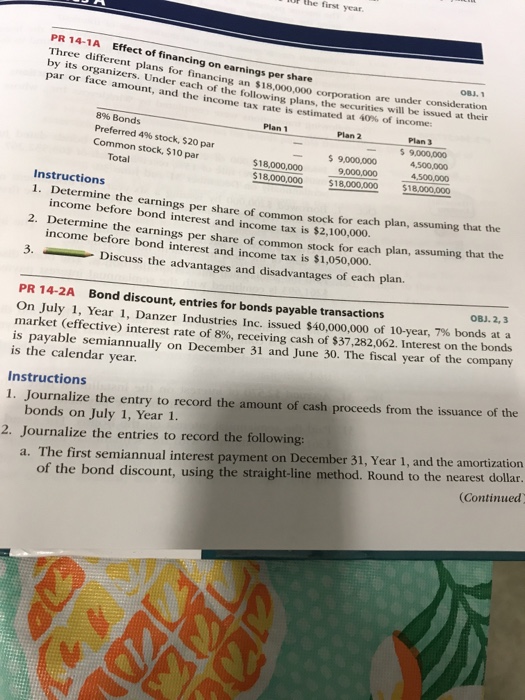

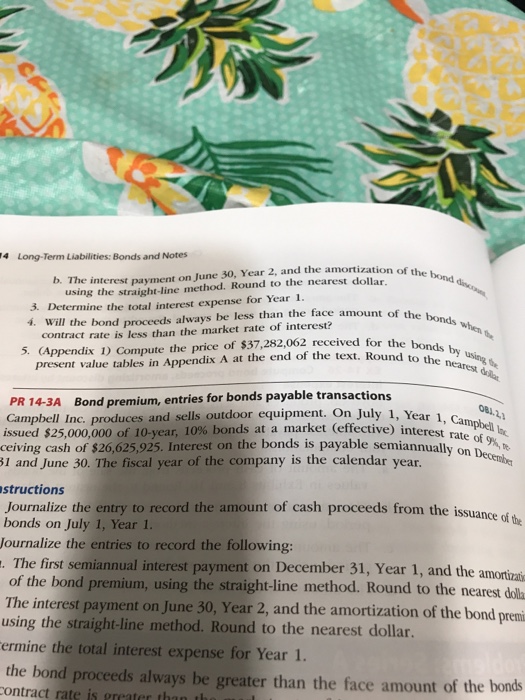

F the first year PR 14-1A Effect of financing on earnings per share Three different plans for financi by its organizers. Under each of par or face amount, and the income tax rate is estimat OBJ. ng an $18,000,000 corporation are under consideration the following plans, the securities will be issued at their ed at 40% of income: Plan 1 8% Bonds Preferred 4% stock. S20 par Common stock, $10 par Plan 2 Plan 3 4,500,000 4,500,000 $18,000,000 18.000,0009000,000 900,00 9,000,000 18,000,000 18000,000 Instructions 1. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $2,100,000. 2. Determine the earnings per share of common stock for each plan, assuming that the 3.Discuss the advantages and disadvantages of each plan. income before bond interest and income tax is $1,050,000. OBJ.2,3 Bond discount, entries for bonds payable transactions Year 1, Danzer Industries Inc. issued $40,000,000 of 10-year, 7% bonds at a PR 14-2A market (effective) interest rate of 8%, receiving cash of $37,282,062. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, Year 1. 2. Journalize the entries to record the following: g the straight-line method. Round to the nearest dollar. Continued al interest payment on December 31, Year 1, and the amortization a. The first semiannu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts