Question: please explain each step. thank u Sunland Corp. reported the following amounts in the shareholders' equity section of its December 31,2022 SFP: During 2023, the

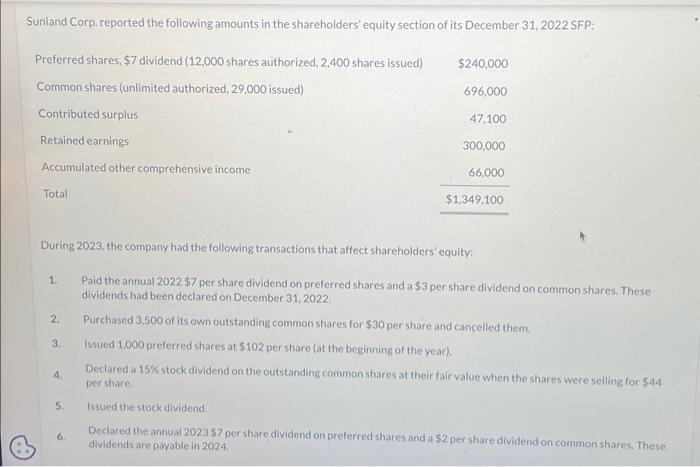

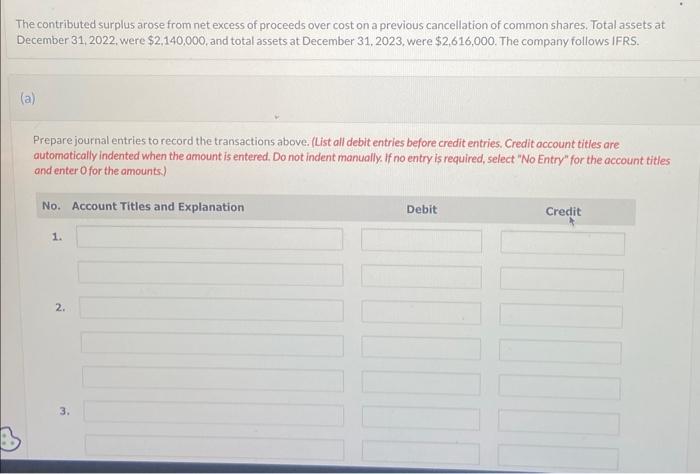

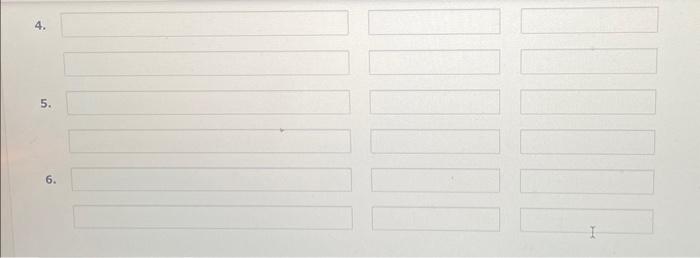

Sunland Corp. reported the following amounts in the shareholders' equity section of its December 31,2022 SFP: During 2023, the company had the following transactions that affect shareholders' equity: 1. Paid the annual 2022$7 per share dividend on preferred shares and a $3 per share dividend on common shares. These dividends had been declared on December 31, 2022. 2. Purchased 3,500 of its own outstanding common shares for $30 per share and cancelled them. 3. Issued 1,000 preferred shares at $102 per share (at the beginning of the year). 4. Declared a 15\% stock dividend on the outstanding common shares at their fair value when the shares were selling for 544 per share. 5. Issued thestock dividend. 6. Declared the annual 2023$7 per share dividend on preferred shares and a $2 per share dividend on common shares. These dividends are payable in 2024 The contributed surplus arose from net excess of proceeds over cost on a previous cancellation of common shares. Total assets at December 31,2022 , were $2,140,000, and total assets at December 31,2023 , were $2,616,000. The company follows IFRS. (a) Prepare journal entries to record the transactions above. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 4. 5. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts