Question: please explain each step with detail, I will give u a thumb! QUESTION TWO The following is the unadjusted trial balance for ABC Manufacturing Inc.

please explain each step with detail, I will give u a thumb!

please explain each step with detail, I will give u a thumb!

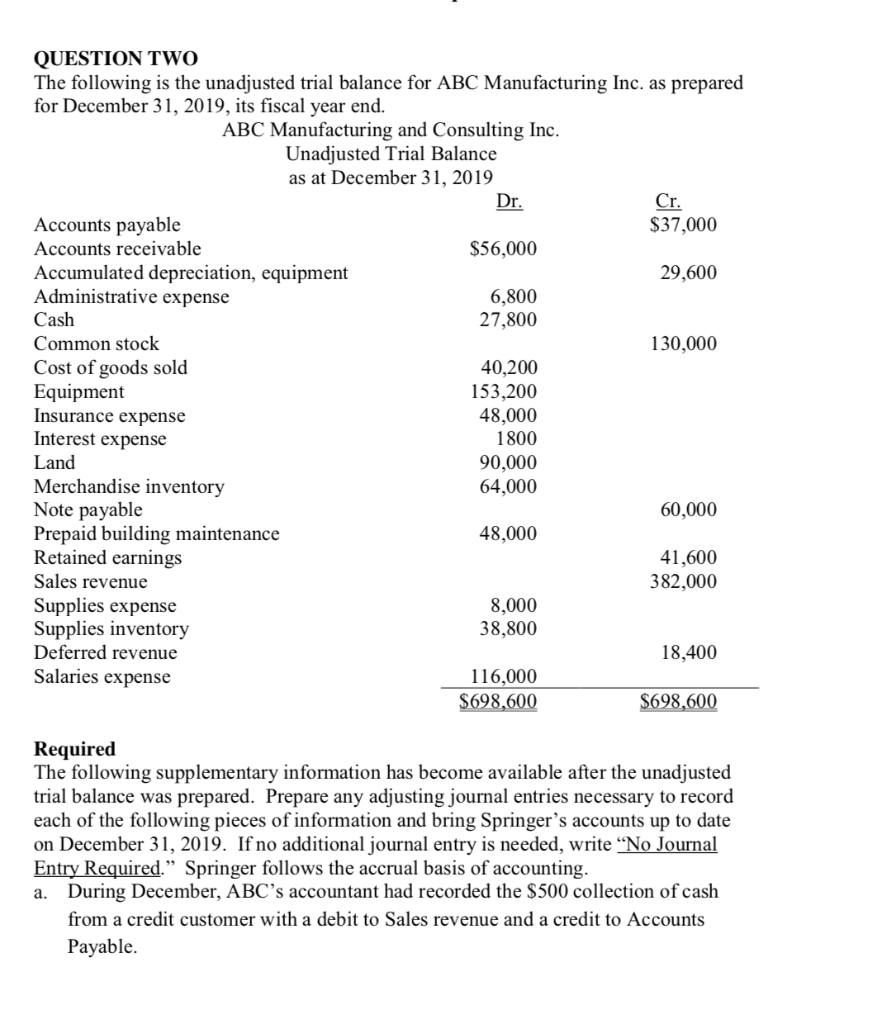

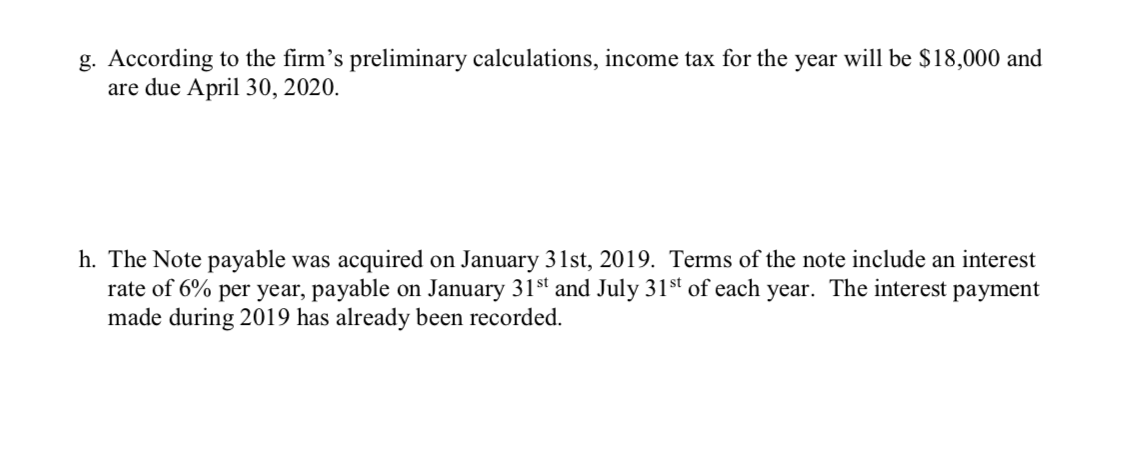

QUESTION TWO The following is the unadjusted trial balance for ABC Manufacturing Inc. as prepared for December 31, 2019, its fiscal year end. ABC Manufacturing and Consulting Inc. Unadjusted Trial Balance as at December 31, 2019 Dr. Cr. Accounts payable $37,000 Accounts receivable $56,000 Accumulated depreciation, equipment 29,600 Administrative expense 6,800 Cash 27,800 Common stock 130,000 Cost of goods sold 40,200 Equipment 153,200 Insurance expense 48,000 Interest expense 1800 Land 90,000 Merchandise inventory 64,000 Note payable 60,000 Prepaid building maintenance 48,000 Retained earnings 41,600 Sales revenue 382,000 Supplies expense 8,000 Supplies inventory 38,800 Deferred revenue 18,400 Salaries expense 116,000 $698,600 $698,600 Required The following supplementary information has become available after the unadjusted trial balance was prepared. Prepare any adjusting journal entries necessary to record each of the following pieces of information and bring Springer's accounts up to date on December 31, 2019. If no additional journal entry is needed, write No Journal Entry Required. Springer follows the accrual basis of accounting. a. During December, ABC's accountant had recorded the $500 collection of cash from a credit customer with a debit to Sales revenue and a credit to Accounts Payable. g. According to the firm's preliminary calculations, income tax for the year will be $18,000 and are due April 30, 2020. h. The Note payable was acquired on January 31st, 2019. Terms of the note include an interest rate of 6% per year, payable on January 31st and July 31st of each year. The interest payment made during 2019 has already been recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts