Question: Please explain each step with detailed explanations and calculations. TY. Assume you manage a well-diversified exist200 million portfolio of U.S. large capitalization stocks, which is

Please explain each step with detailed explanations and calculations. TY.

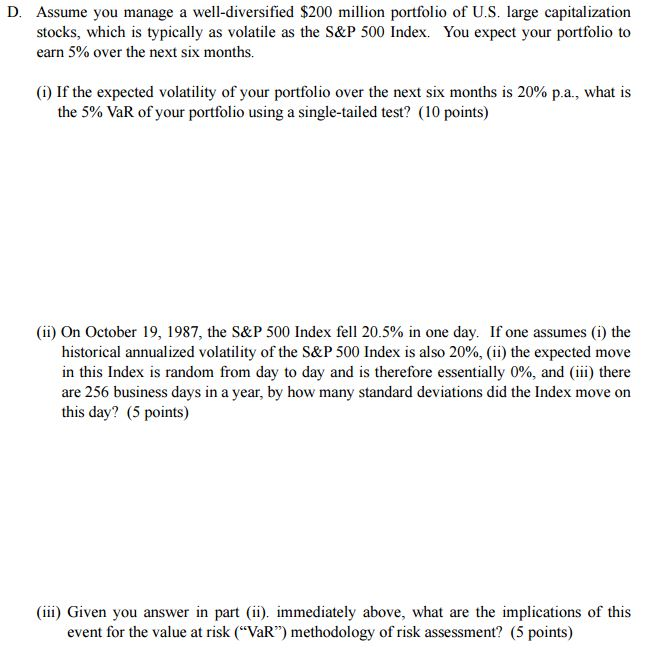

Assume you manage a well-diversified exist200 million portfolio of U.S. large capitalization stocks, which is typically as volatile as the S&P 500 Index. You expect your portfolio to earn 5% over the next six months. (i) If the expected volatility of your portfolio over the next six months is 20% p.a., what is the 5% VaR of your portfolio using a single-tailed test? (ii) On October 19, 1987, the S&P 500 Index fell 20.5% in one day. If one assumes (i) the historical annualized volatility of the S&P 500 Index is also 20%, (ii) the expected move in this Index is random from day to day and is therefore essentially 0%, and (iii) there are 256 business days in a year, by how many standard deviations did the Index move on this day? (iii) Given you answer in part (ii). immediately above, what are the implications of this event for the value at risk ("VaR") methodology of risk assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts