Question: Please explain equations used. #2 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new

Please explain equations used.

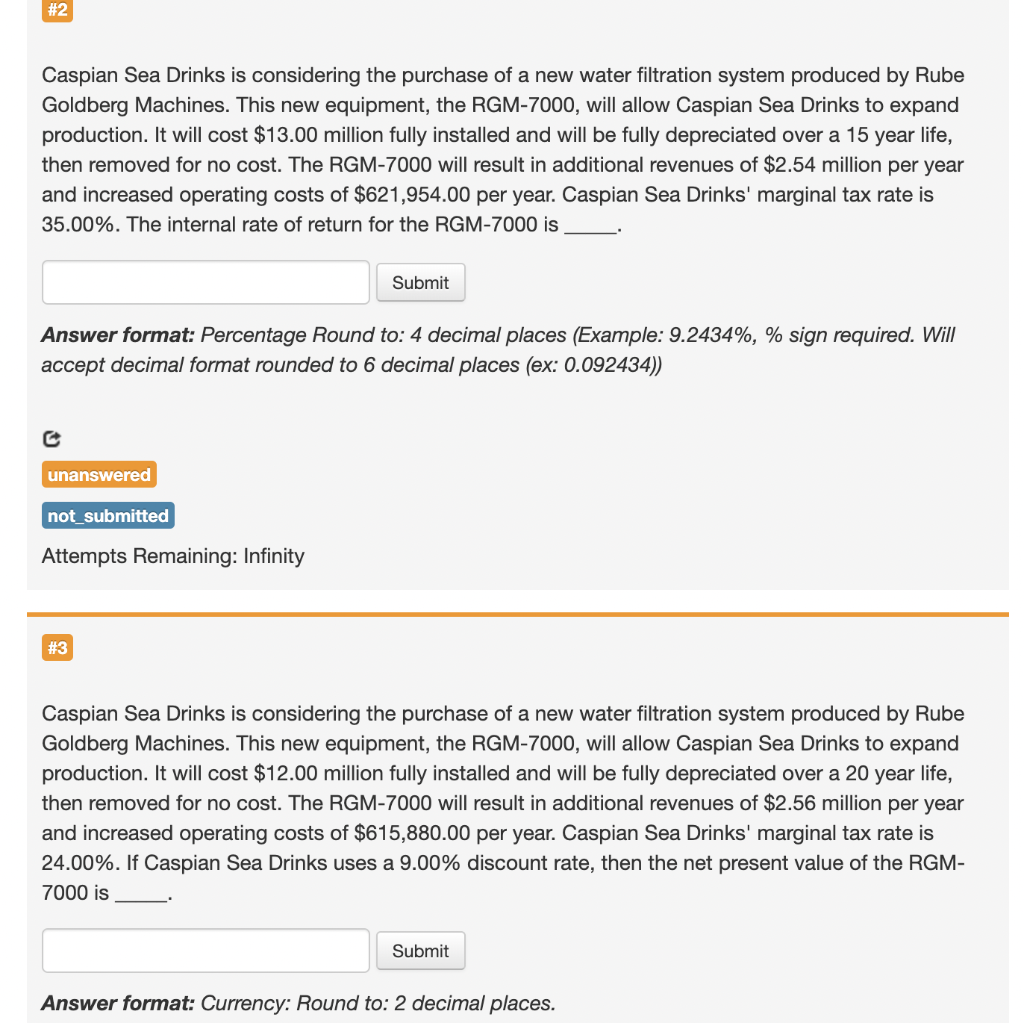

#2 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 15 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.54 million per year and increased operating costs of $621,954.00 per year. Caspian Sea Drinks' marginal tax rate is 35.00%. The internal rate of return for the RGM-7000 is Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434)) c unanswered not_submitted Attempts Remaining: Infinity #3 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $12.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $2.56 million per year and increased operating costs of $615,880.00 per year. Caspian Sea Drinks' marginal tax rate is 24.00%. If Caspian Sea Drinks uses a 9.00% discount rate, then the net present value of the RGM- 7000 is Submit Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts