Question: please explain every number on this example. Thank you!! Example: Quantitative Measurement & Consistent Framework Consider portfolio of $20 mil nominal of 10-year US Treasury

please explain every number on this example. Thank you!!

please explain every number on this example. Thank you!!

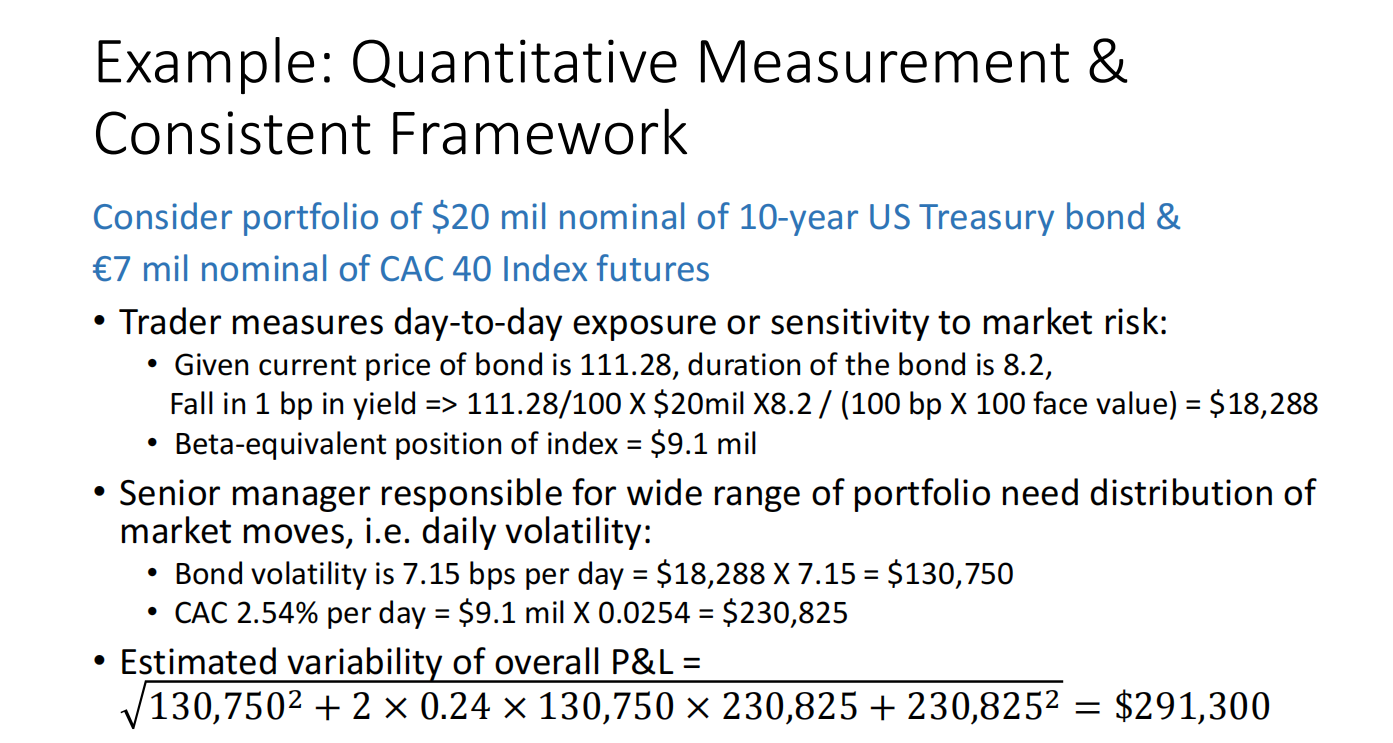

Example: Quantitative Measurement \& Consistent Framework Consider portfolio of $20 mil nominal of 10-year US Treasury bond \& 7 mil nominal of CAC 40 Index futures - Trader measures day-to-day exposure or sensitivity to market risk: - Given current price of bond is 111.28, duration of the bond is 8.2, Fall in 1bp in yield =>111.28/100$20mil8.2/(100bp100 face value )=$18,288 - Beta-equivalent position of index =$9.1 mil - Senior manager responsible for wide range of portfolio need distribution of market moves, i.e. daily volatility: - Bond volatility is 7.15 bps per day =$18,2887.15=$130,750 - CAC 2.54% per day =$9.1 mil X0.0254=$230,825 - Estimated variability of overall P&L= 130,7502+20.24130,750230,825+230,8252=$291,300 Example: Quantitative Measurement \& Consistent Framework Consider portfolio of $20 mil nominal of 10-year US Treasury bond \& 7 mil nominal of CAC 40 Index futures - Trader measures day-to-day exposure or sensitivity to market risk: - Given current price of bond is 111.28, duration of the bond is 8.2, Fall in 1bp in yield =>111.28/100$20mil8.2/(100bp100 face value )=$18,288 - Beta-equivalent position of index =$9.1 mil - Senior manager responsible for wide range of portfolio need distribution of market moves, i.e. daily volatility: - Bond volatility is 7.15 bps per day =$18,2887.15=$130,750 - CAC 2.54% per day =$9.1 mil X0.0254=$230,825 - Estimated variability of overall P&L= 130,7502+20.24130,750230,825+230,8252=$291,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts