Question: please explain every part and show formulas. The Glover Scholastic Aid Foundation has received a 20 million global government bond portfolio from a Greek donor.

please explain every part and show formulas.

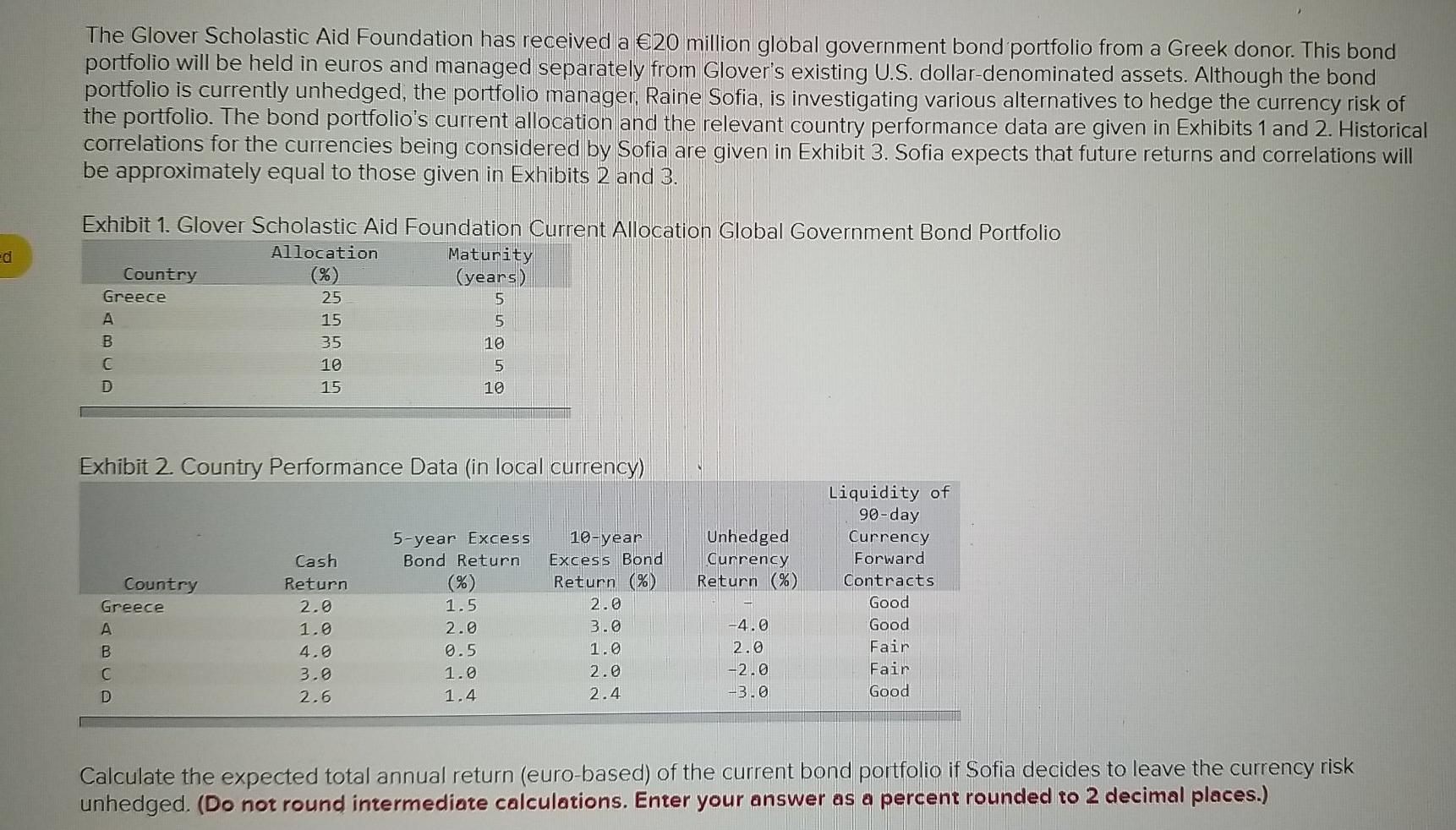

The Glover Scholastic Aid Foundation has received a 20 million global government bond portfolio from a Greek donor. This bond portfolio will be held in euros and managed separately from Glover's existing U.S. dollar-denominated assets. Although the bond portfolio is currently unhedged, the portfolio manager, Raine Sofia, is investigating various alternatives to hedge the currency risk of the portfolio. The bond portfolio's current allocation and the relevant country performance data are given in Exhibits 1 and 2. Historical correlations for the currencies being considered by Sofia are given in Exhibit 3. Sofia expects that future returns and correlations will be approximately equal to those given in Exhibits 2 and 3. ed Exhibit 1. Glover Scholastic Aid Foundation Current Allocation Global Government Bond Portfolio Allocation Maturity Country (years) Greece 25 5 A 15 5 B 35 10 C 10 5 D 15 10 Exhibit 2. Country Performance Data (in local currency) 5-year Excess Bond Return Unhedged Currency Return (%) Country Greece A Cash Return 2.0 1.0 4.0 3.0 2.5 Liquidity of 90-day Currency Forward Contracts Good Good Fair Fair Good 10-year Excess Bond Return (%) 2.0 3.0 1.0 2.0 2.4 1.5 2.0 0.5 1.0 1.4 B -4.0 2.0 -2.0 -3.0 C D Calculate the expected total annual return (euro-based) of the current bond portfolio if Sofia decides to leave the currency risk unhedged. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts