Question: please explain every step!! 6) The following chart provides price (P) and number of shares outstanding (Q) data for stocks A,B, and C at the

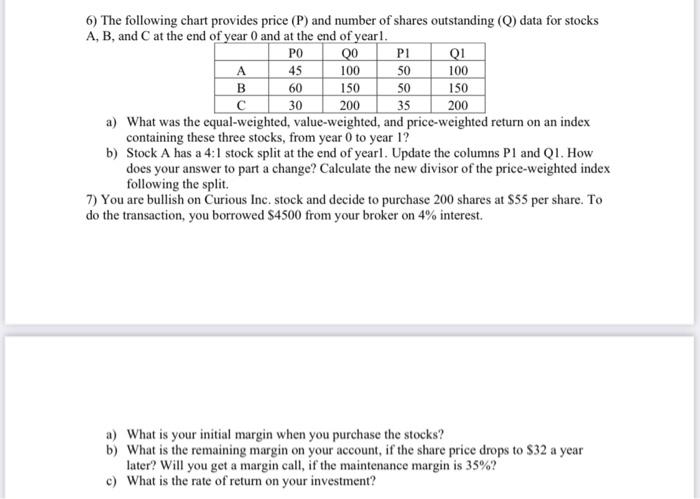

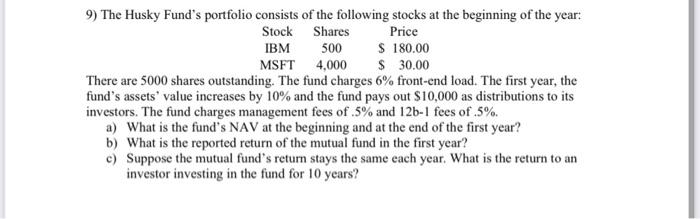

6) The following chart provides price (P) and number of shares outstanding (Q) data for stocks A,B, and C at the end of year 0 and at the end of yearl. a) What was the equal-weighted, value-weighted, and price-weighted return on an index containing these three stocks, from year 0 to year 1 ? b) Stock A has a 4:1 stock split at the end of yearl. Update the columns P1 and Q1. How does your answer to part a change? Calculate the new divisor of the price-weighted index following the split. 7) You are bullish on Curious Inc. stock and decide to purchase 200 shares at $55 per share. To do the transaction, you borrowed $4500 from your broker on 4% interest. a) What is your initial margin when you purchase the stocks? b) What is the remaining margin on your account, if the share price drops to $32 a year later? Will you get a margin call, if the maintenance margin is 35% ? c) What is the rate of return on your investment? There are 5000 shares outstanding. The fund charges 6% front-end load. The first year, the fund's assets' value increases by 10% and the fund pays out $10,000 as distributions to its investors. The fund charges management fees of . 5% and 12b1 fees of .5%. a) What is the fund's NAV at the beginning and at the end of the first year? b) What is the reported return of the mutual fund in the first year? c) Suppose the mutual fund's return stays the same each year. What is the return to an investor investing in the fund for 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts