Question: Please explain every step, and Round the final answer to 4 decimal places. Question 2 BBC Inc. is an all-equity financed firm. It has 6,000

Please explain every step, and Round the final answer to 4 decimal places.

Please explain every step, and Round the final answer to 4 decimal places.

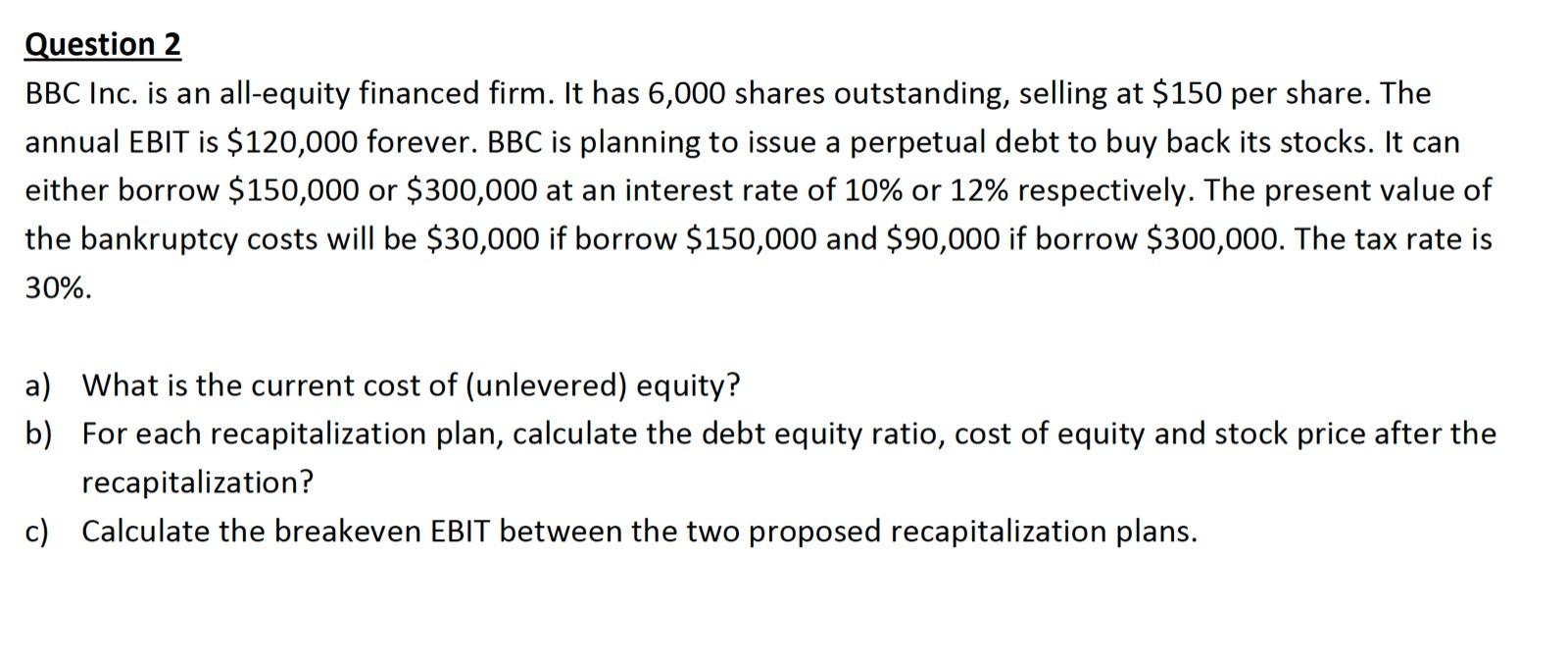

Question 2 BBC Inc. is an all-equity financed firm. It has 6,000 shares outstanding, selling at $150 per share. The annual EBIT is $120,000 forever. BBC is planning to issue a perpetual debt to buy back its stocks. It can either borrow $150,000 or $300,000 at an interest rate of 10% or 12% respectively. The present value of the bankruptcy costs will be $30,000 if borrow $150,000 and $90,000 if borrow $300,000. The tax rate is 30%. a) What is the current cost of (unlevered) equity? b) For each recapitalization plan, calculate the debt equity ratio, cost of equity and stock price after the recapitalization? c) Calculate the breakeven EBIT between the two proposed recapitalization plans. Question 2 BBC Inc. is an all-equity financed firm. It has 6,000 shares outstanding, selling at $150 per share. The annual EBIT is $120,000 forever. BBC is planning to issue a perpetual debt to buy back its stocks. It can either borrow $150,000 or $300,000 at an interest rate of 10% or 12% respectively. The present value of the bankruptcy costs will be $30,000 if borrow $150,000 and $90,000 if borrow $300,000. The tax rate is 30%. a) What is the current cost of (unlevered) equity? b) For each recapitalization plan, calculate the debt equity ratio, cost of equity and stock price after the recapitalization? c) Calculate the breakeven EBIT between the two proposed recapitalization plans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts