Question: please explain every step. need to understand the equation .. thank you Bennie Razor Company has decided to sell one of its old truck on

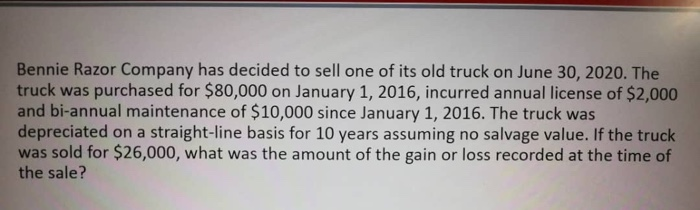

Bennie Razor Company has decided to sell one of its old truck on June 30, 2020. The truck was purchased for $80,000 on January 1, 2016, incurred annual license of $2,000 and bi-annual maintenance of $10,000 since January 1, 2016. The truck was depreciated on a straight-line basis for 10 years assuming no salvage value. If the truck was sold for $26,000, what was the amount of the gain or loss recorded at the time of the sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts