Question: Please explain everything on how to calculate this including steps to type into the financial calculator. Bond Return 4: You bought a $10,000-face 1%-coupon bond

Please explain everything on how to calculate this including steps to type into the financial calculator.

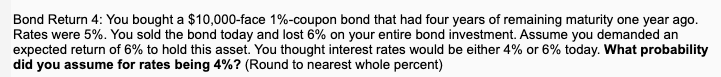

Bond Return 4: You bought a $10,000-face 1%-coupon bond that had four years of remaining maturity one year ago. Rates were 5%. You sold the bond today and lost 6% on your entire bond investment. Assume you demanded an expected return of 6% to hold this asset. You thought interest rates would be either 4% or 6% today. What probability did you assume for rates being 4%? (Round to nearest whole percent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts