Question: Please explain exactly how to get each row in the chart. I have the answer for A but I am confused. They gave the zero

Please explain exactly how to get each row in the chart.

I have the answer for A but I am confused. They gave the zero rate for six months and a year however, I don't understand how they got those exact numbers. Please show how to get all of the forward and zero rates.

Please help!

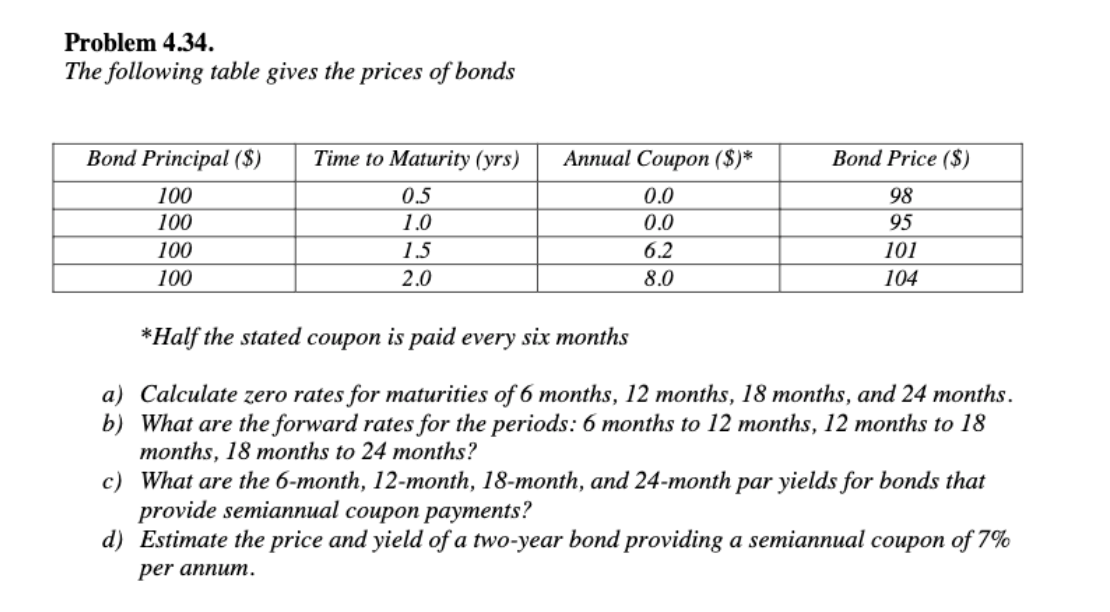

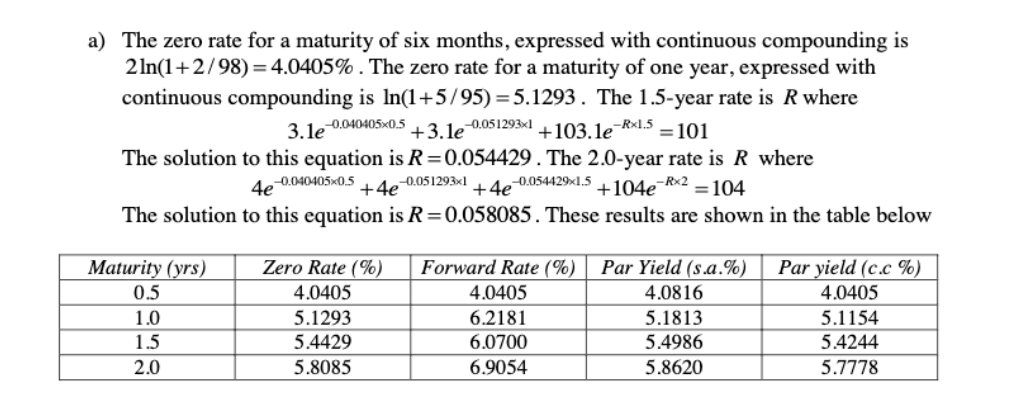

Problem 4.34. The following table gives the prices of bonds Time to Maturity (yrs) Bond Price ($) Bond Principal ($) 100 100 100 100 0.5 1.0 1.5 2.0 Annual Coupon ($)* 0.0 0.0 6.2 8.0 98 95 101 104 *Half the stated coupon is paid every six months a) Calculate zero rates for maturities of 6 months, 12 months, 18 months, and 24 months. b) What are the forward rates for the periods: 6 months to 12 months, 12 months to 18 months, 18 months to 24 months? c) What are the 6-month, 12-month, 18-month, and 24-month par yields for bonds that provide semiannual coupon payments? d) Estimate the price and yield of a two-year bond providing a semiannual coupon of 7% per annum. a) The zero rate for a maturity of six months, expressed with continuous compounding is 2ln(1+2/98) = 4.0405% . The zero rate for a maturity of one year, expressed with continuous compounding is In(1+5/95) = 5.1293. The 1.5-year rate is R where 1 +3.le = 101 The solution to this equation is R=0.054429. The 2.0-year rate is R where 4e + 4e +104e-Rx2 = 104 The solution to this equation is R=0.058085. These results are shown in the table below 3. le 0.040405x0.5 -0.051293x1 +103.le-Rx1.5 -0.040405x0.5 -0.054429x1.5 + 4e -0.051293x1 Maturity (yrs) 0.5 1.0 1.5 2.0 Zero Rate (%) 4.0405 5.1293 5.4429 5.8085 Forward Rate (%) 4.0405 6.2181 6.0700 6.9054 Par Yield (s.a.%) 4.0816 5.1813 5.4986 5.8620 Par yield (c.c %) 4.0405 5.1154 5.4244 5.7778

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts