Question: Please explain for me what the coefficients and t Stat show in this regression. On January 2004, a multi factor regression analysis of Apple's stock

Please explain for me what the coefficients and t Stat show in this regression.

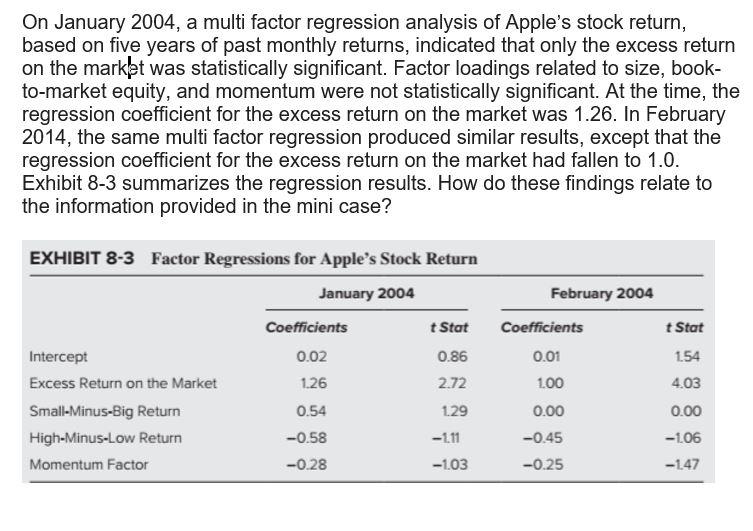

On January 2004, a multi factor regression analysis of Apple's stock return, based on five years of past monthly returns, indicated that only the excess return on the market was statistically significant. Factor loadings related to size, book- to-market equity, and momentum were not statistically significant. At the time, the regression coefficient for the excess return on the market was 1.26. In February 2014, the same multi factor regression produced similar results, except that the regression coefficient for the excess return on the market had fallen to 1.0. Exhibit 8-3 summarizes the regression results. How do these findings relate to the information provided in the mini case? EXHIBIT 8-3 Factor Regressions for Apple's Stock Return tStat t Stat 1.54 January 2004 Coefficients 0.02 1.26 0.54 -0.58 -0.28 Intercept Excess Return on the Market Small-Minus-Big Return High-Minus-Low Return Momentum Factor 0.86 2.72 129 February 2004 Coefficients 0.01 1.00 0.00 -0.45 -0.25 4.03 0.00 -106 -1.11 -1.03 -147 On January 2004, a multi factor regression analysis of Apple's stock return, based on five years of past monthly returns, indicated that only the excess return on the market was statistically significant. Factor loadings related to size, book- to-market equity, and momentum were not statistically significant. At the time, the regression coefficient for the excess return on the market was 1.26. In February 2014, the same multi factor regression produced similar results, except that the regression coefficient for the excess return on the market had fallen to 1.0. Exhibit 8-3 summarizes the regression results. How do these findings relate to the information provided in the mini case? EXHIBIT 8-3 Factor Regressions for Apple's Stock Return tStat t Stat 1.54 January 2004 Coefficients 0.02 1.26 0.54 -0.58 -0.28 Intercept Excess Return on the Market Small-Minus-Big Return High-Minus-Low Return Momentum Factor 0.86 2.72 129 February 2004 Coefficients 0.01 1.00 0.00 -0.45 -0.25 4.03 0.00 -106 -1.11 -1.03 -147

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts