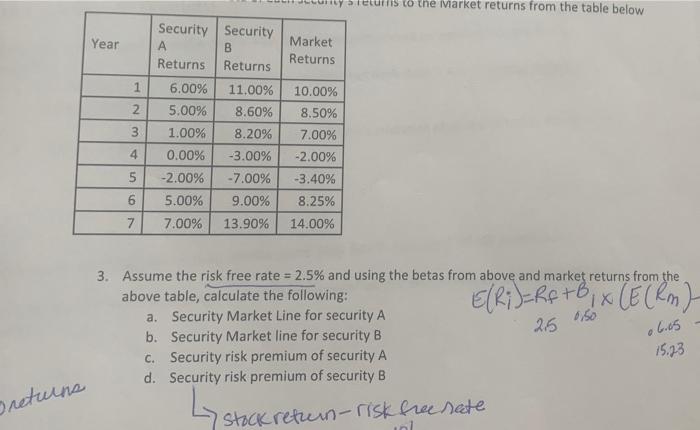

Question: please explain formulas use and excel instructions beturis to the varket returns from the table below Security Security Year B Market Returns Returns Returns 1

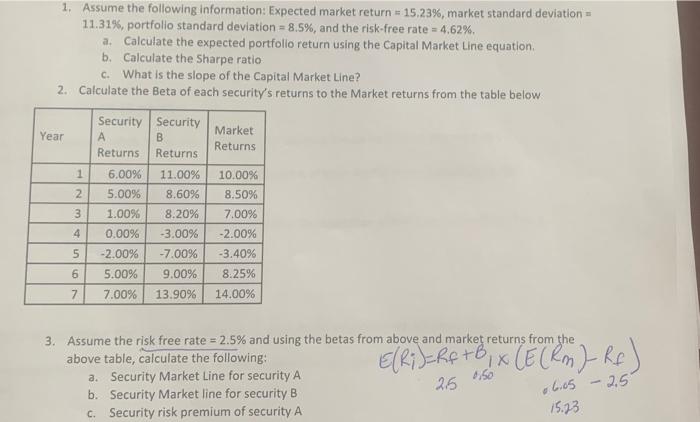

beturis to the varket returns from the table below Security Security Year B Market Returns Returns Returns 1 6.00% 11.00% 10.00% 2 5.00% 8.60% 8.50% 3 1.00% 8.20% 7.00% 4 0.00% -3.00% -2.00% 5 -2.00% -7.00% -3.40% 6 5.00% 9.00% 8.25% 7 7.00% 13.90% 14.00% ElR;)=Rf +6 X (E(km) 3. Assume the risk free rate = 2.5% and using the betas from above and market returns from the above table, calculate the following: a. Security Market Line for security A 6,50 25 b. Security Market line for security B C. Security risk premium of security A d. Security risk premium of security B .6.us 15.33 o returns List Istock return-risk free rate 1. Assume the following information: Expected market return -15.23%, market standard deviation - 11.31%, portfolio standard deviation = 8.5%, and the risk-free rate = 4.62%. a. Calculate the expected portfolio return using the Capital Market Line equation b. Calculate the Sharpe ratio C. What is the slope of the Capital Market Line? 2. Calculate the Beta of each security's returns to the Market returns from the table below Market Year Security Security A B Returns Returns Returns 1 6.00% 11.00% 10.00% 2 5.00% 8.60% 8.50% 3 1.00% 8.20% 7.00% 4 0.00% -3.00% -2.00% 5 -2.00% -7.00% -3.40% 6 5.00% 9.00% 8.25% 7 7.00% 13.90% 14.00% 3. Assume the risk free rate = 2.5% and using the betas from above and market returns from the E(Ri)=Rf +6, X (E(Rom) Re above table, calculate the following: a. Security Market Line for security A b. Security Market line for security B c. Security risk premium of security A 25 4.05 - 2.5 15.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts