Question: Please explain how exactly to get parts c and d. I have the answers however I am not sure exactly how to get it. Please

Please explain how exactly to get parts c and d. I have the answers however I am not sure exactly how to get it. Please thoroughly explain how to get each part because I am very confused, thanks!

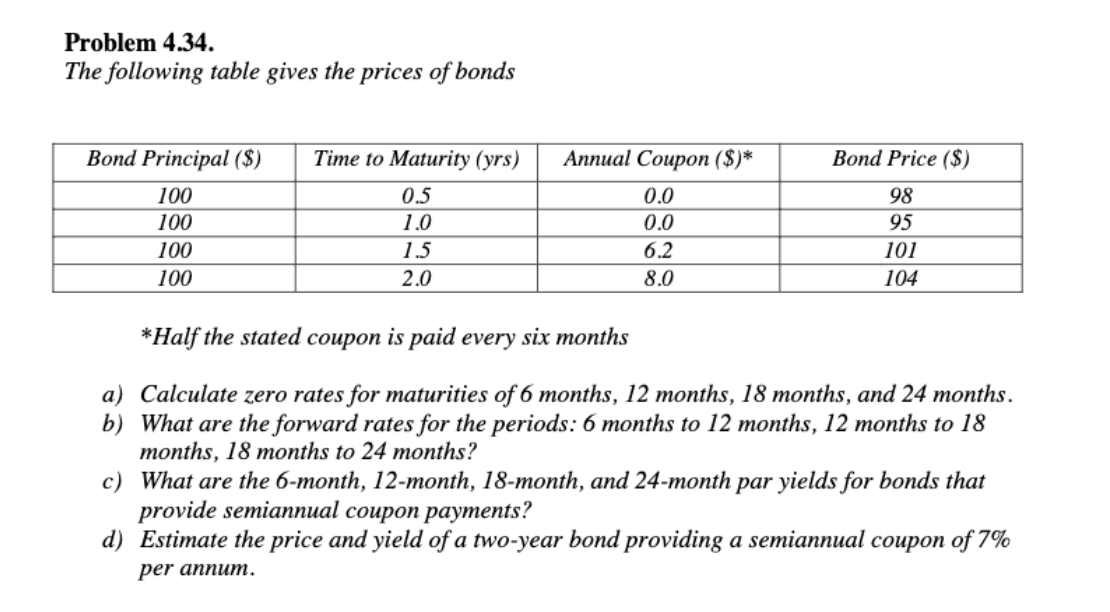

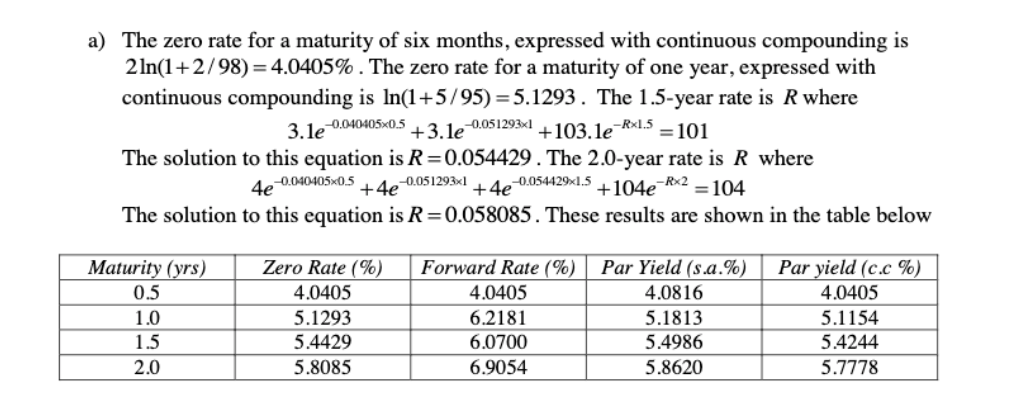

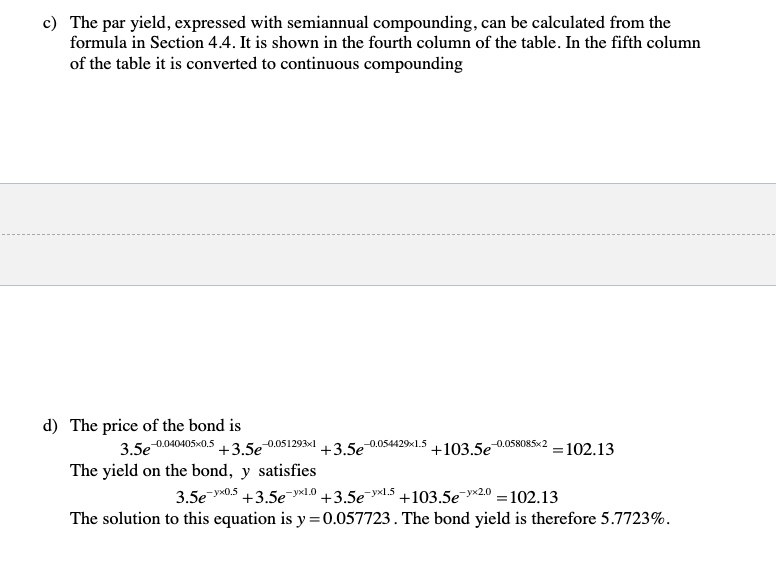

Problem 4.34. The following table gives the prices of bonds Time to Maturity (yrs) Bond Price ($) Bond Principal ($) 100 100 100 100 0.5 1.0 1.5 2.0 Annual Coupon ($)* 0.0 0.0 6.2 8.0 98 95 101 104 *Half the stated coupon is paid every six months a) Calculate zero rates for maturities of 6 months, 12 months, 18 months, and 24 months. b) What are the forward rates for the periods: 6 months to 12 months, 12 months to 18 months, 18 months to 24 months? c) What are the 6-month, 12-month, 18-month, and 24-month par yields for bonds that provide semiannual coupon payments? d) Estimate the price and yield of a two-year bond providing a semiannual coupon of 7% per annum. a) The zero rate for a maturity of six months, expressed with continuous compounding is 2ln(1+2/98) = 4.0405% . The zero rate for a maturity of one year, expressed with continuous compounding is In(1+5/95) = 5.1293. The 1.5-year rate is R where 1 +3.le = 101 The solution to this equation is R=0.054429. The 2.0-year rate is R where 4e + 4e +104e-Rx2 = 104 The solution to this equation is R=0.058085. These results are shown in the table below 3. le 0.040405x0.5 -0.051293x1 +103.le-Rx1.5 -0.040405x0.5 -0.054429x1.5 + 4e -0.051293x1 Maturity (yrs) 0.5 1.0 1.5 2.0 Zero Rate (%) 4.0405 5.1293 5.4429 5.8085 Forward Rate (%) 4.0405 6.2181 6.0700 6.9054 Par Yield (s.a.%) 4.0816 5.1813 5.4986 5.8620 Par yield (c.c %) 4.0405 5.1154 5.4244 5.7778 c) The par yield, expressed with semiannual compounding, can be calculated from the formula in Section 4.4. It is shown in the fourth column of the table. In the fifth column of the table it is converted to continuous compounding d) The price of the bond is +103.5e 0.058085*2 = 102.13 The yield on the bond, y satisfies +103.5ex2.0 = 102.13 The solution to this equation is y=0.057723. The bond yield is therefore 5.7723%. 3.5e9.040405x0.5 +3.5e -0.0512931 +3.5e -0.054429x1.5 3.5ex0.5 +3.5e-yxl.0 +3.5e-9x1,5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts