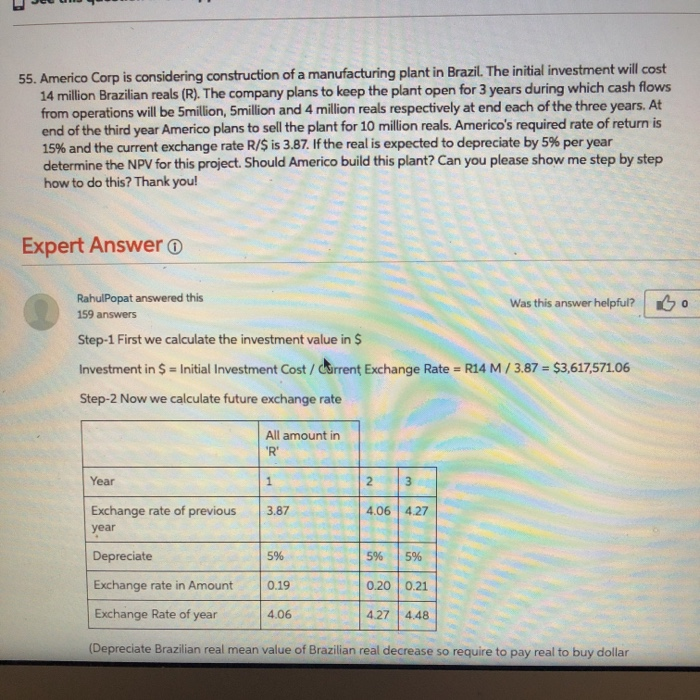

Question: please explain how he got the exchange rate in amount of 0.19,0.20,0.21? and also how he got the DF@15% numbers of 1.000,0.8696,0.7561,0.6575 55. Americo Corp

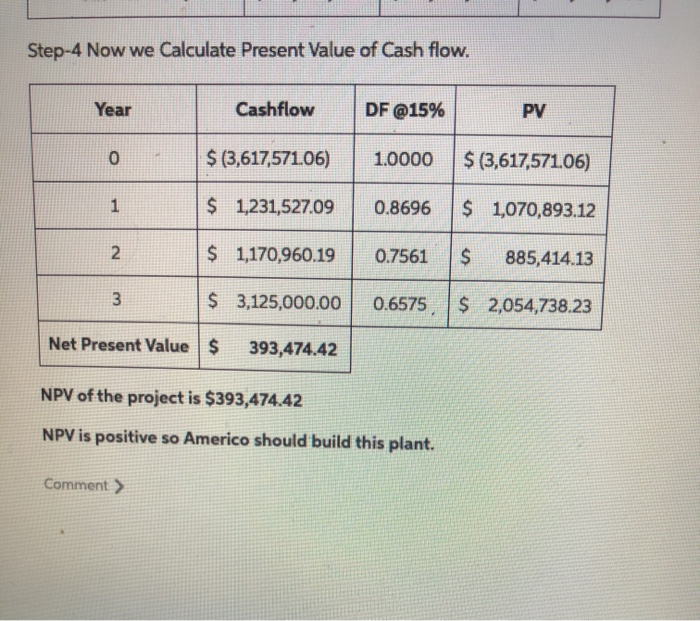

55. Americo Corp is considering construction of a manufacturing plant in Brazil. The initial investment will cost 14 million Brazilian reals (R). The company plans to keep the plant open for 3 years during which cash flows from operations will be 5million, 5million and 4 million reals respectively at end each of the three years. At end of the third year Americo plans to sell the plant for 10 million reals. America's required rate of return is 15% and the current exchange rate R/$ is 3.87. If the real is expected to depreciate by 5% per year determine the NPV for this project. Should Americo build this plant? Can you please show me step by step how to do this? Thank you! Expert Answer RahulPopat answered this Was this answer helpful? 159 answers Step-1 First we calculate the investment value in $ Investment in $ = Initial Investment Cost / Current Exchange Rate = R14 M/3.87 = $3,617,571.06 Step-2 Now we calculate future exchange rate All amount in 'R Year 1 2 3 3.87 4.06 4.27 Exchange rate of previous year Depreciate 5% 5% 5% Exchange rate in Amount 0.19 0.20 0.21 Exchange Rate of year 4.06 4.27 4.48 (Depreciate Brazilian real mean value of Brazilian real decrease so require to pay real to buy dollar Step-4 Now we Calculate Present Value of Cash flow. Year Cashflow DF @15% PV 0 $ (3,617,571.06) 1.0000 $ (3,617,571.06) 1 $ 1,231,527.09 0.8696 $ 1,070,893.12 2. $ 1,170,960.19 0.7561 $ 885,414.13 3 $ 3,125,000.00 0.6575 $ 2,054,738.23 Net Present Value $ 393,474.42 NPV of the project is $393,474.42 NPV is positive so Americo should build this plant. Comment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts