Question: please explain how it is a loss if net assets are greater than cash AP-14A LO 8 Patricia, Karla and Nathan operate a small law

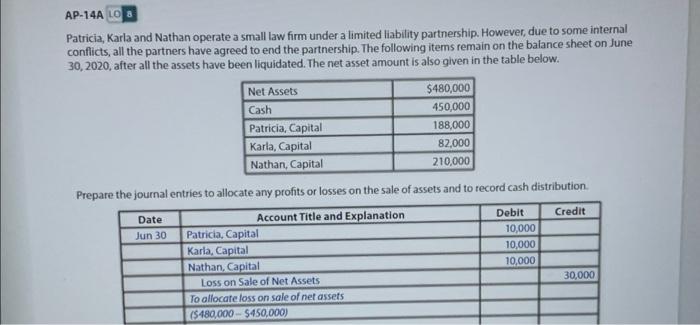

AP-14A LO 8 Patricia, Karla and Nathan operate a small law firm under a limited liability partnership. However, due to some internal conflicts, all the partners have agreed to end the partnership. The following items remain on the balance sheet on June 30, 2020, after all the assets have been liquidated. The net asset amount is also given in the table below. Net Assets $480,000 Cash 450,000 Patricia, Capital 188,000 Karla, Capital 82,000 Nathan, Capital 210,000 Prepare the journal entries to allocate any profits or losses on the sale of assets and to record cash distribution. Date Account Title and Explanation Debit Credit Jun 30 Patricia, Capital Karla, Capital Nathan, Capital Loss on Sale of Net Assets To allocate loss on sale of net assets ($480,000-$450,000) 10,000 10,000 10,000 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts