Question: PLEASE EXPLAIN HOW THE NUMBER CIRCLED WAS CALCULATED Consider a bond with an equity warrant. The warrant entitles the bondholder to buy 25 shares of

PLEASE EXPLAIN HOW THE NUMBER CIRCLED WAS CALCULATED

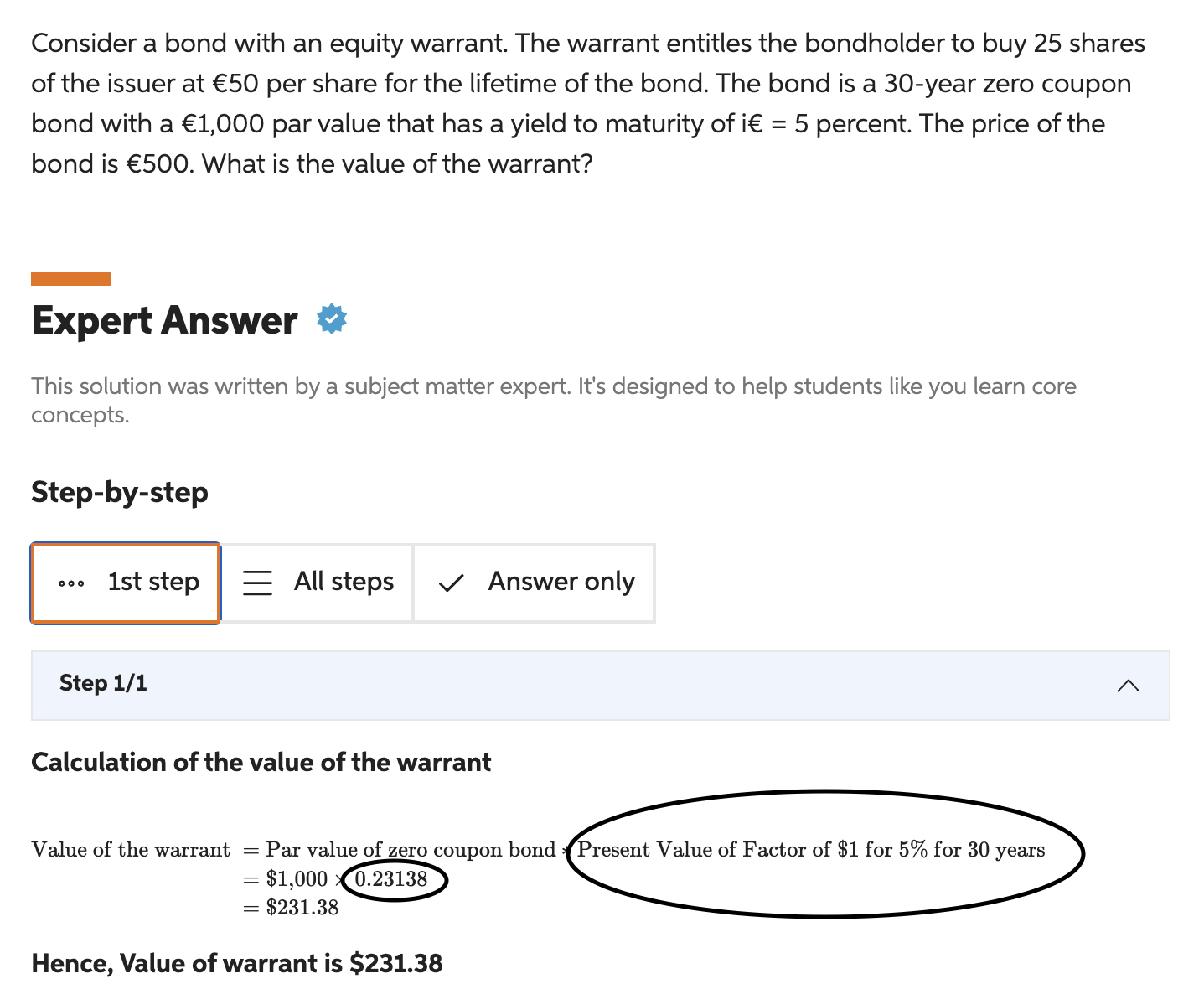

Consider a bond with an equity warrant. The warrant entitles the bondholder to buy 25 shares of the issuer at 50 per share for the lifetime of the bond. The bond is a 30 -year zero coupon bond with a 1,000 par value that has a yield to maturity of i=5 percent. The price of the bond is 500. What is the value of the warrant? Expert Answer This solution was written by a subject matter expert. It's designed to help students like you learn core concepts. Step-by-step Step 1/1 Calculation of the value of the warrant Value of the warrant = Par value of zero coupon bond Present Value of Factor of $1 for 5% for 30 years =$1,0000.23138 =$231.38 Hence, Value of warrant is $$231.38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts