Question: Please explain how the Put option lattice was created given the stock price lattice. How did they obtain the values 0.338722, 0.0600613, 0.844913, etc. given

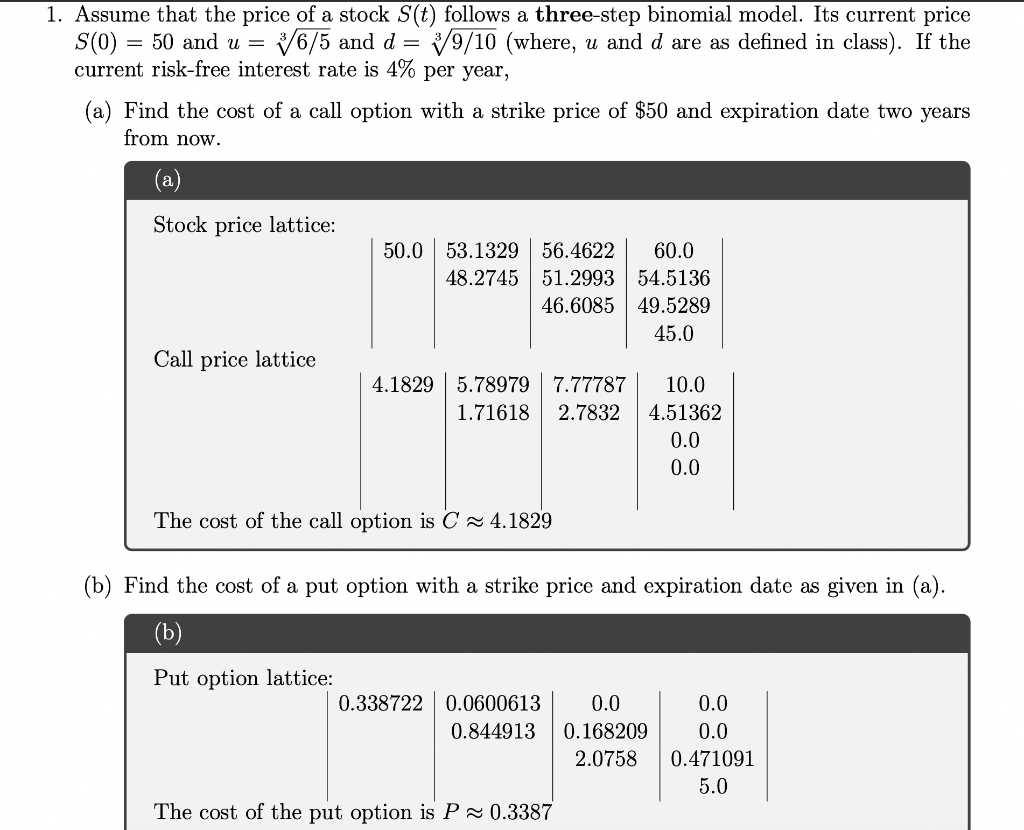

Please explain how the "Put option lattice" was created given the stock price lattice. How did they obtain the values 0.338722, 0.0600613, 0.844913, etc. given the stock price lattice? Show the steps please.

Please explain how the "Put option lattice" was created given the stock price lattice. How did they obtain the values 0.338722, 0.0600613, 0.844913, etc. given the stock price lattice? Show the steps please.

Assume that the price of a stock S(t) follows a three-step binomial model. Its current price S(0)=50 and u=36/5 and d=39/10 (where, u and d are as defined in class). If the current risk-free interest rate is 4% per year, (a) Find the cost of a call option with a strike price of $50 and expiration date two years from now. (a) Ctanl.....n-a 1nttinn. The cost of the call option is C4.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts