Question: PLEASE EXPLAIN HOW TO CALCULATE EACH REQUIREMENT 1,2,3,3&5 . I attached a example from a pervious expert . Please demestrate like this. Len Wison is

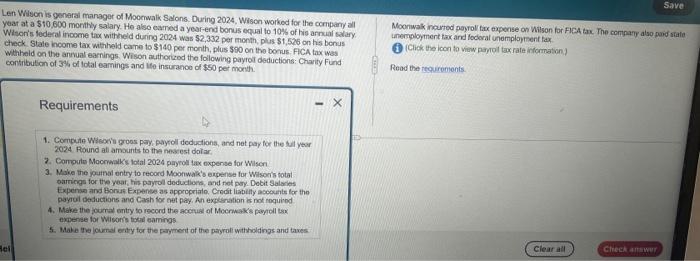

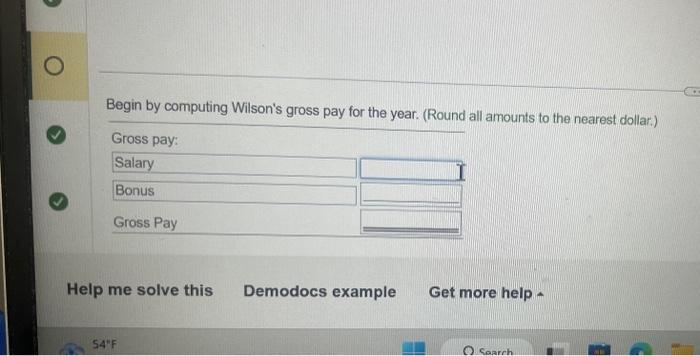

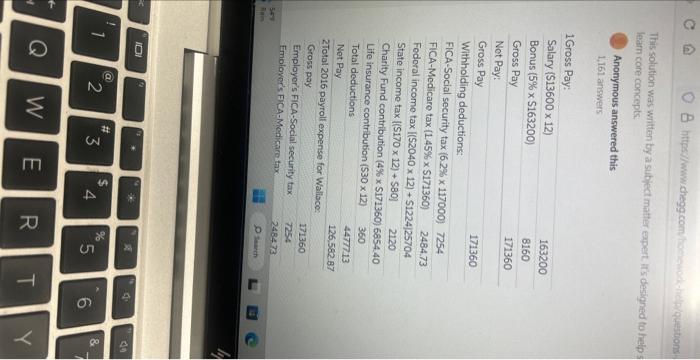

Len Wison is goneral manager of Moornwalk Salons. During 2024. Wiscn workod for the company al year at a $10,600 monthy salary. Ho also eamed a year-end bonus equal to 10% of his arnuar salary Wisor's lederal income tax witheed during 2024 was $2,332 per month, plus $1,526 on his bonus Moonwakincurtod paryol fax expense on Wison for FCA tar. The comgany also puod state unersploymert tax and focorat unemployment lax check 5 tale hoome tax withineld came to $140 per month, plus $90 on tho bonus. FCCA faxwes withheld on the annual eamings. Wison authoreod the following payrol deductions: Chavity Fund (C) iClick the icon to vitw pagrol tax rate information? contribution of 34 of lotal eamings and lifo insurance of $50 per mornth. Read the regurements. Requirements 1. Compuite Wisoci groos pay. Palycoll doductions, and net pay for the hul year 2024 Found ali amounts to the nescest doliar 7. Conpule Mocrwalks lotal 2024 puyrol tax nxpense for Wisen 3. Make the jputnal entry to record Moonwak's expense for Wilsoris fotal oamrings for the year, his payrol deductions, and net pory. Debit Salesies Expense and Bonut Expense as appropriato. Credit liabilfy asoounts for paytul doductions and Cash for net pay, An expeinatian is not roquivod 4. Make the poural entry to record the accense of Moenwakks paygoll tse? expense for Wileonit total eamings 5. Make the foumal eraty for the paymert of the payroli withholdings and taxes: Begin by computing Wilson's gross pay for the vear. (Round all amounts to the nearest dollar.) This solution was written by a subject matter expert. it's designed to help leairn core concepts. Anonymous answered this 1,161 answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts