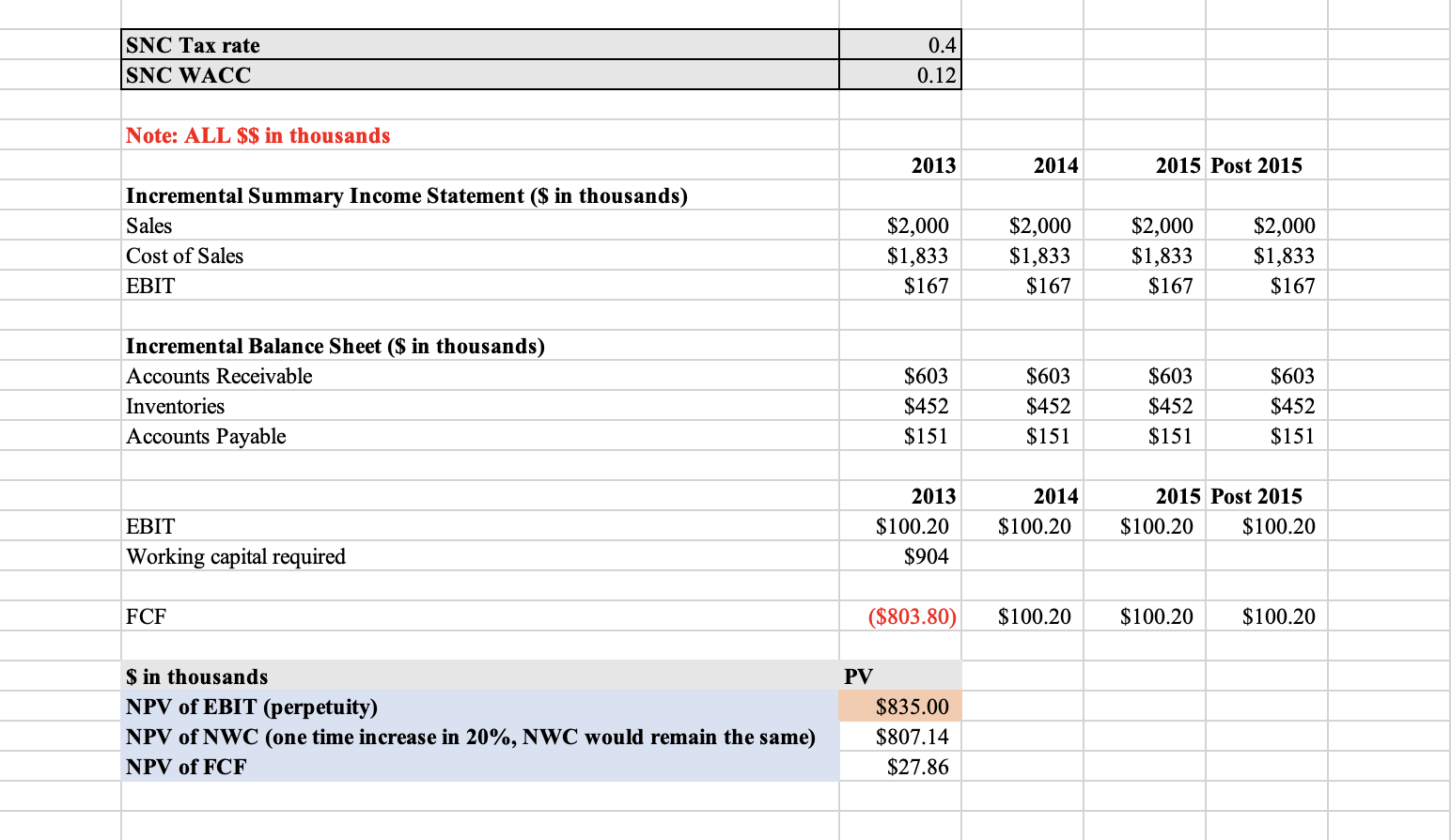

Question: Please explain how to calculate NPV of EBIT perpetuity value (highlighted orange cell). I have noted down what the correct answer should be but unsure

Please explain how to calculate NPV of EBIT perpetuity value (highlighted orange cell). I have noted down what the correct answer should be but unsure what formula to use to get that answer.

SNC Tax rate SNC WACC Note: ALL $$ in thousands Incremental Summary Income Statement ($ in thousands) Sales Cost of Sales EBIT Incremental Balance Sheet ($ in thousands) Accounts Receivable Inventories Accounts Payable EBIT Working capital required FCF $ in thousands PV NPV of EBIT (perpetuity) NPV of NWC (one time increase in 20%, NWC would remain the same) NPV of FCF 0.4 0.12 2013 $2,000 $1,833 $167 $603 $452 $151 2013 $100.20 $904 ($803.80) $835.00 $807.14 $27.86 2014 $2,000 $1,833 $167 $603 $452 $151 2014 $100.20 $100.20 2015 Post 2015 $2,000 $2,000 $1,833 $1,833 $167 $167 $603 $603 $452 $452 $151 $151 2015 Post 2015 $100.20 $100.20 $100.20 $100.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts