Question: Please explain how to calculate this to get an answer like the key above for number 126, 127, 137, and 145Chapter : CURRENT LIABILITIES AND

Please explain how to calculate this to get an answer like the key above for number 126, 127, 137, and 145Chapter : CURRENT LIABILITIES AND PAYROLL ACCOUNTING126. The entry to record accrual of Lane Company's payroll taxes would include a127. The entry to record the accrual of federal unemployment taxes would include a137. Blake Company has ten employees who each earn $160 per day. If they accumulate vacation time at the rate of 1.5 vacation days for each month worked, the amount of vacation benefits that should be accrued at the end of the month is145. Mike Kohl, an employee of Spottswood Company, has gross earnings for the month of October of $6,000. FICA taxes are 8% of gross earnings, federal income taxes amount to $952 for the month, state income taxes are 2% of gross earnings, and Mike authorizes voluntary deductions of $15 per month to the United Fund. What is the net pay for Mike Kohl?

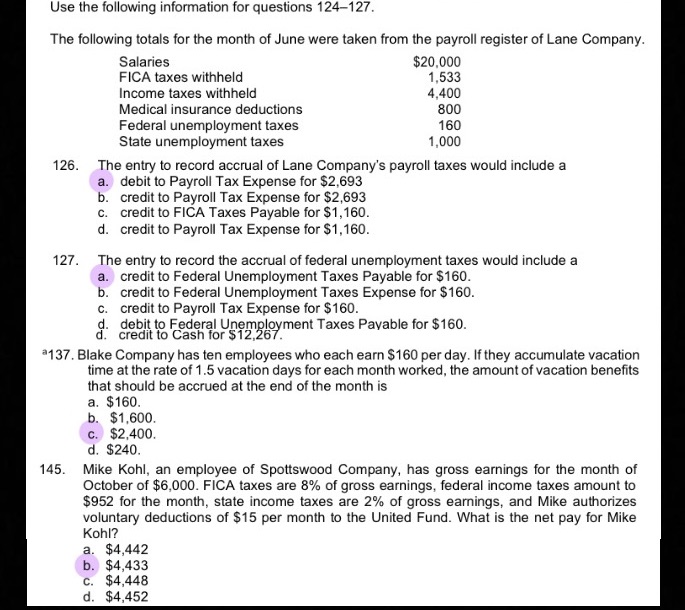

Use the following information for questions 124-127. The following totals for the month of June were taken from the payroll register of Lane Company. Salaries $20,000 FICA taxes withheld 1,533 Income taxes withheld 4.400 Medical insurance deductions 800 Federal unemployment taxes 160 State unemployment taxes 1,000 126. The entry to record accrual of Lane Company's payroll taxes would include a a. debit to Payroll Tax Expense for $2,693 b. credit to Payroll Tax Expense for $2,693 c. credit to FICA Taxes Payable for $1, 160. d. credit to Payroll Tax Expense for $1, 160. 127. The entry to record the accrual of federal unemployment taxes would include a a. credit to Federal Unemployment Taxes Payable for $160. b. credit to Federal Unemployment Taxes Expense for $160. c. credit to Payroll Tax Expense for $160. d. d. debit to Federal Unemployment Taxes Payable for $160. credit to Cash for $12,267. 137. Blake Company has ten employees who each earn $160 per day. If they accumulate vacation time at the rate of 1.5 vacation days for each month worked, the amount of vacation benefits that should be accrued at the end of the month is a. $160. b. $1,600. C. $2,400. d. $240. 145. Mike Kohl, an employee of Spottswood Company, has gross earnings for the month of October of $6,000. FICA taxes are 8% of gross earnings, federal income taxes amount to $952 for the month, state income taxes are 2% of gross earnings, and Mike authorizes voluntary deductions of $15 per month to the United Fund. What is the net pay for Mike Kohl? a. $4,442 b. $4,433 C. $4,448 d. $4,452