Question: Please explain how to do it. Thank you Question 16 0 / 1 point 2/1/13 3/14/13 5/1/13 Purchase Purchase Purchase Units 18 31 22 Cost/unit

Please explain how to do it. Thank you

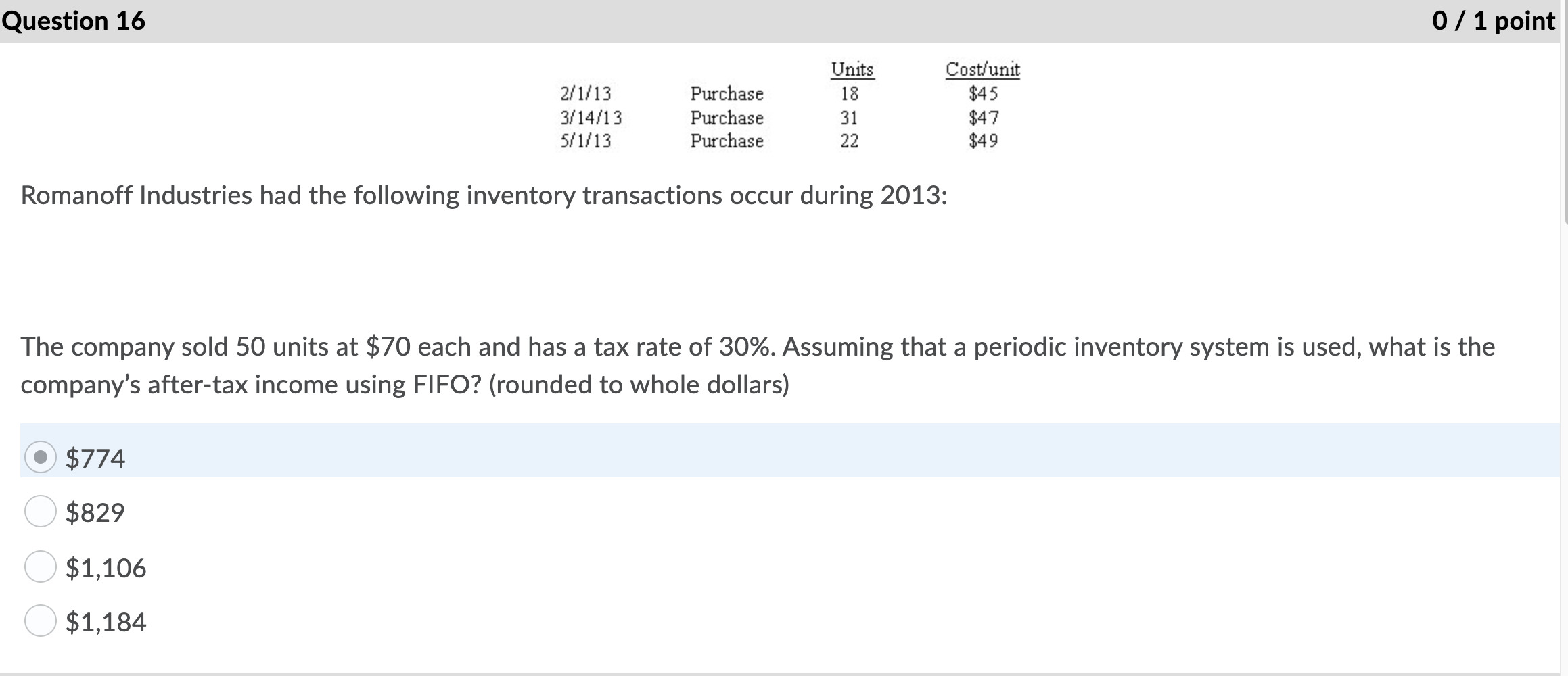

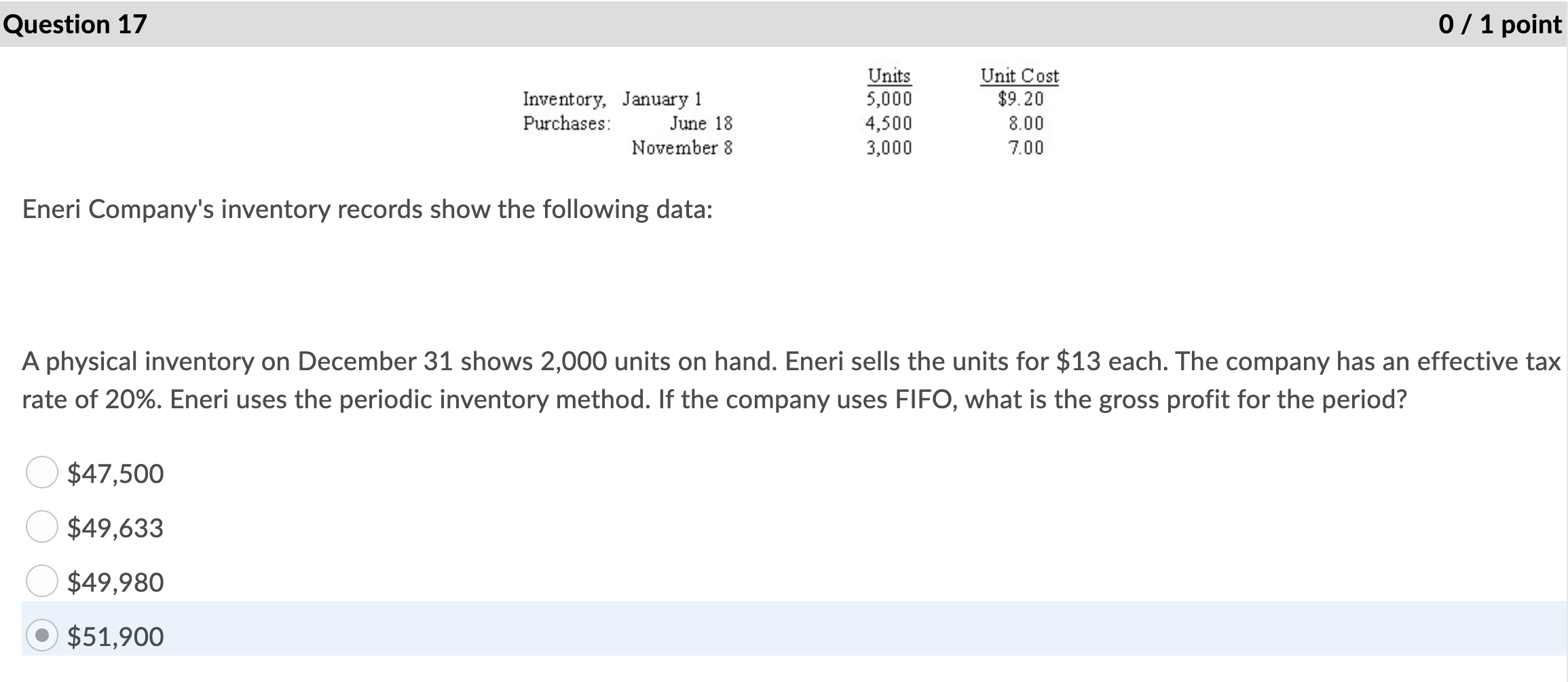

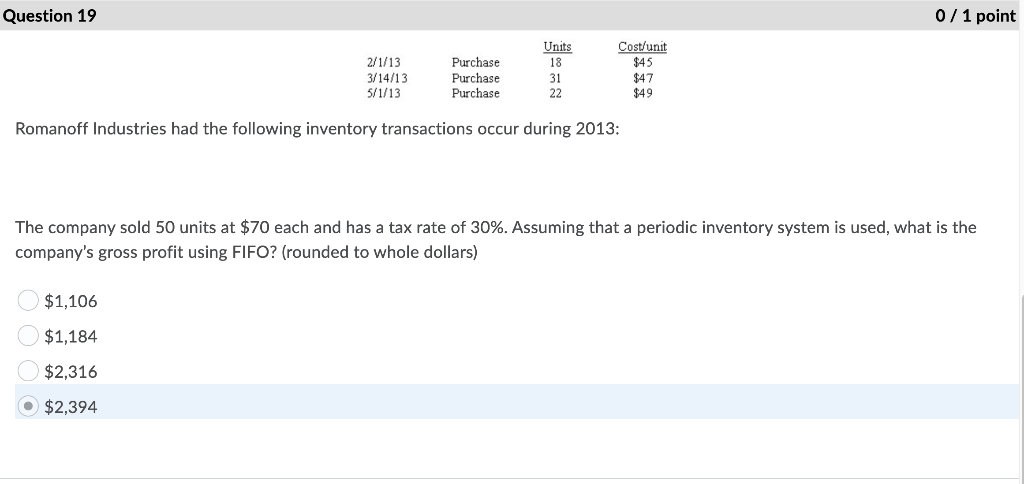

Question 16 0 / 1 point 2/1/13 3/14/13 5/1/13 Purchase Purchase Purchase Units 18 31 22 Cost/unit $45 $47 $49 Romanoff Industries had the following inventory transactions occur during 2013: The company sold 50 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars) $774 $829 $1,106 $1,184 Question 17 0 / 1 point Inventory, January 1 Purchases: June 18 November 8 Units 5,000 4,500 3,000 Unit Cost $9.20 8.00 7.00 Eneri Company's inventory records show the following data: A physical inventory on December 31 shows 2,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. If the company uses FIFO, what is the gross profit for the period? $47,500 $49,633 $49,980 $51,900 Question 19 0/1 point 2/1/13 3/14/13 5/1/13 Purchase Purchase Purchase Units 18 31 22 Cost/unit $45 $47 $49 Romanoff Industries had the following inventory transactions occur during 2013: The company sold 50 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars) $1,106 $1,184 $2,316 $2,394

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts