Question: Please explain how to do part C! Thank you. Stocks A and B have the following returns AWN 1 2 3 4 5 Stock A

Please explain how to do part C! Thank you.

Please explain how to do part C! Thank you.

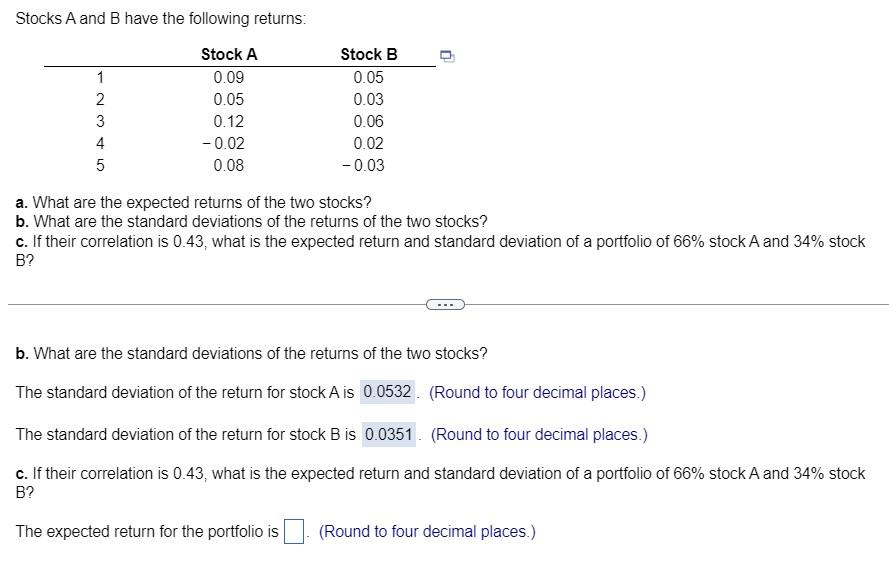

Stocks A and B have the following returns AWN 1 2 3 4 5 Stock A 0.09 0.05 0.12 -0.02 0.08 Stock B 0.05 0.03 0.06 0.02 -0.03 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.43, what is the expected return and standard deviation of a portfolio of 66% stock A and 34% stock B? b. What are the standard deviations of the returns of the two stocks? The standard deviation of the return for stock Ais 0.0532. (Round to four decimal places.) The standard deviation of the return for stock B is 0.0351. (Round to four decimal places.) c. If their correlation is 0.43, what is the expected return and standard deviation of a portfolio of 66% stock A and 34% stock B? The expected return for the portfolio is (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts