Question: please explain how to do problems on a financial calculator (BA II Plus) if possible! You have saved $6,064 for a down payment on a

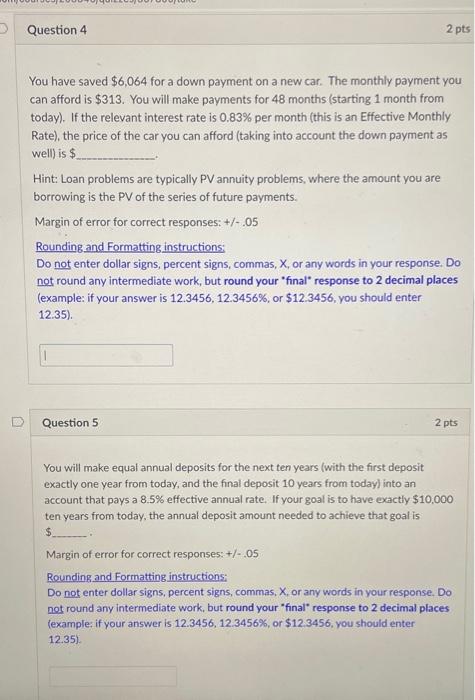

You have saved $6,064 for a down payment on a new car. The monthly payment you can afford is $313. You will make payments for 48 months (starting 1 month from today). If the relevant interest rate is 0.83% per month (this is an Effective Monthly Rate), the price of the car you can afford (taking into account the down payment as well) is $ Hint: Loan problems are typically PV annuity problems, where the amount you are borrowing is the PV of the series of future payments. Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Question 5 2 pts You will make equal annual deposits for the next ten years (with the first deposit exactly one year from today, and the final deposit 10 years from today) into an account that pays a 8.5% effective annual rate. If your goal is to have exactly $10,000 ten years from today, the annual deposit amount needed to achieve that goal is $ Margin of error for correct responses: +1.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts