Question: please explain how to do this on a financial calculater thankyou! Q19: Capital Budgeting (11 marks) Milne Inc. is considering two locations for a new

please explain how to do this on a financial calculater thankyou!

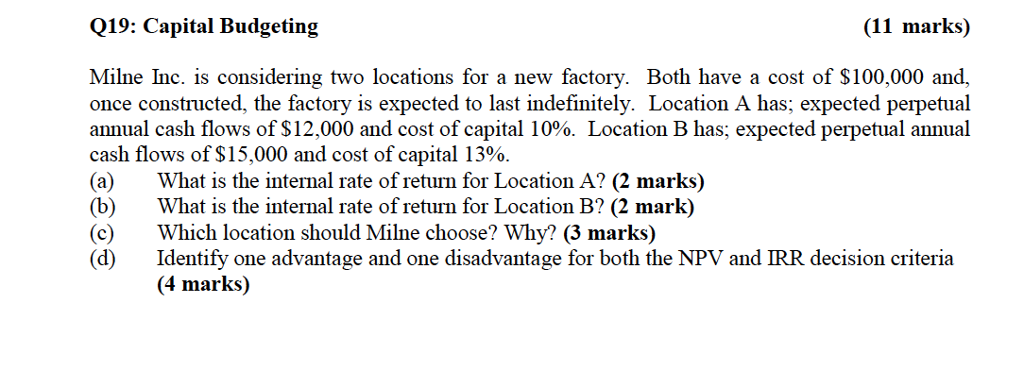

Q19: Capital Budgeting (11 marks) Milne Inc. is considering two locations for a new factory. Both have a cost of $100,000 and, once constructed, the factory is expected to last indefinitely. Location A has; expected perpetual annual cash flows of $12.000 and cost of capital 10%, Location B has, expected perpetual annual cash flows of $15,000 and cost of capital 13% (a) What is the internal rate of return for Location A? (2 marks) (b) What is the internal rate of return for Location B? (2 mark) (c)Which location should Milne choose? Why? (3 marks) (d) Identify one advantage and one disadvantage for both the NPV and IRR decision criteria (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts