Question: please explain how to do this. Question B8 The company PDR Ltd is listed on the Australian Securities Exchange (ASX). The company conducted an off-market

please explain how to do this.

please explain how to do this.

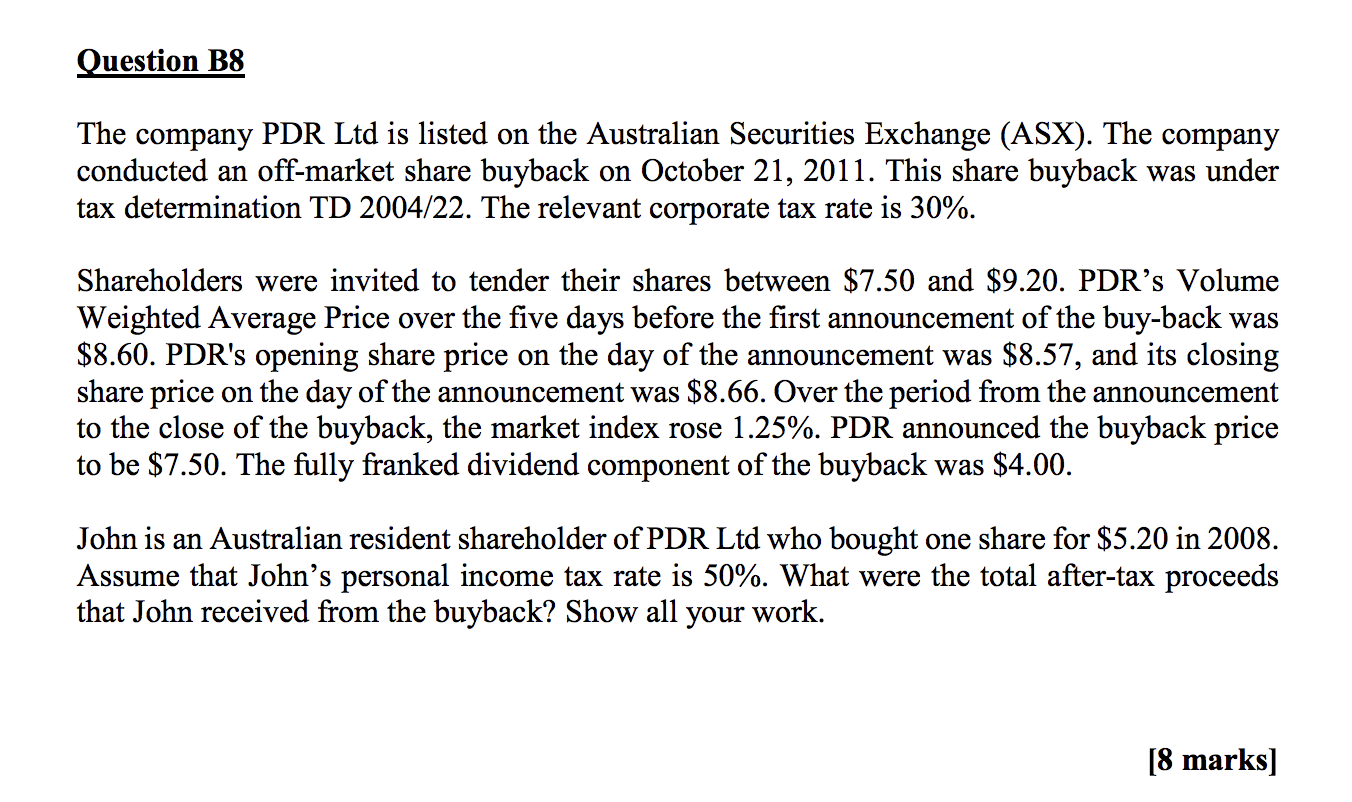

Question B8 The company PDR Ltd is listed on the Australian Securities Exchange (ASX). The company conducted an off-market share buyback on October 21, 2011. This share buyback was under tax determination TD 2004/22. The relevant corporate tax rate is 30%. Shareholders were invited to tender their shares between $7.50 and $9.20. PDR's Volume Weighted Average Price over the five days before the first announcement of the buy-back was $8.60. PDR's opening share price on the day of the announcement was $8.57, and its closing share price on the day of the announcement was $8.66. Over the period from the announcement to the close of the buyback, the market index rose 1.25%. PDR announced the buyback price to be $7.50. The fully franked dividend component of the buyback was $4.00. John is an Australian resident shareholder of PDR Ltd who bought one share for $5.20 in 2008. Assume that John's personal income tax rate is 50%. What were the total after-tax proceeds that John received from the buyback? Show all your work. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts