Question: please explain how to find these numbers after old net income Short Answer Questions.docx ter 8 Short Answer Questions.docx (76 KB) ZO Page of 2

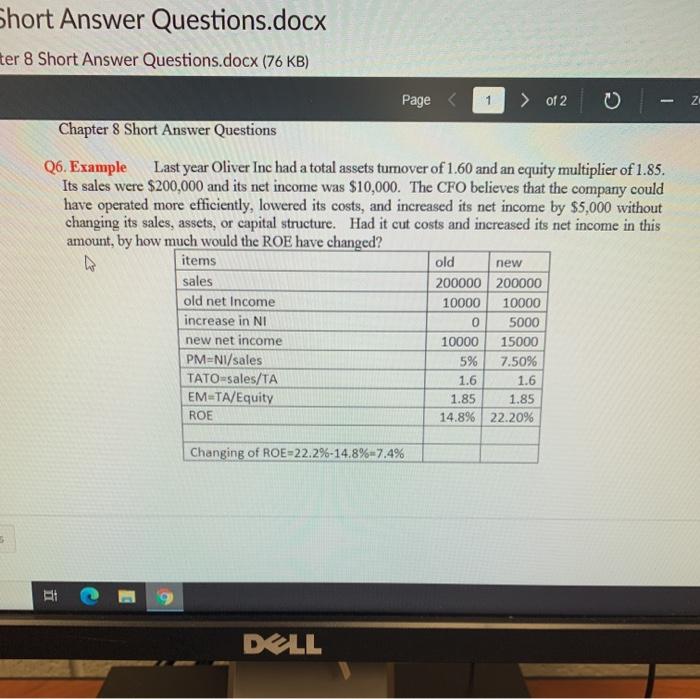

Short Answer Questions.docx ter 8 Short Answer Questions.docx (76 KB) ZO Page of 2 Chapter 8 Short Answer Questions Q6. Example Last year Oliver Inc had a total assets tumover of 1.60 and an equity multiplier of 1.85. Its sales were $200,000 and its net income was $10,000. The CFO believes that the company could have operated more efficiently, lowered its costs, and increased its net income by $5,000 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income in this amount, by how much would the ROE have changed? items new sales 200000 200000 old net Income 10000 10000 increase in NI 0 5000 new net income 10000 15000 PMENI/sales 5% 7.50% TATO-sales/TA 1.6 1.6 EM-TA/Equity 1.85 ROE 14.8% 22.20% old 1.85 Changing of ROE=22.2%-14.8%-7.4% DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts