Question: please explain how to get answer. Thank you. Seorge operates a business that generated revenues of $66million and allocable taxable income of $1.41 million. included

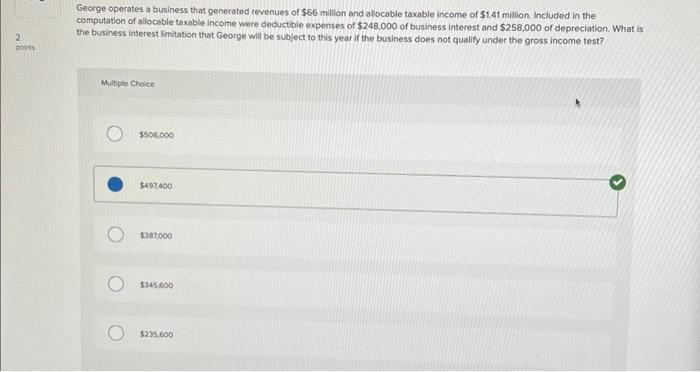

Seorge operates a business that generated revenues of $66million and allocable taxable income of $1.41 million. included in the computation of allocable taxable income were deductible expenses of $248,000 of business interest and $258,000 of depreciation. What is the business interest limitation that George will be subject to this year if the business does not qualify under the gross income test? Muliple cholce $506,000 $497,400 1387,000 $345,000 $235600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts