Question: Please explain how to get C-1 & C-2 answers, not sure what the issue is... thx in advance The Pioneer Petroleum Corporation has a bond

Please explain how to get C-1 & C-2 answers, not sure what the issue is... thx in advance

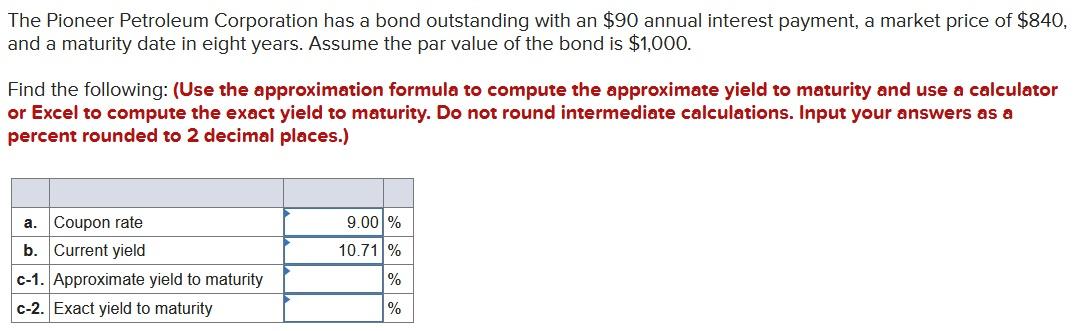

The Pioneer Petroleum Corporation has a bond outstanding with an $90 annual interest payment, a market price of $840, and a maturity date in eight years. Assume the par value of the bond is $1,000. Find the following: (Use the approximation formula to compute the approximate yield to maturity and use a calculator or Excel to compute the exact yield to maturity. Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) 9.00% 10.71% a. Coupon rate b. Current yield C-1. Approximate yield to maturity C-2. Exact yield to maturity % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts