Question: please explain how to get the answer Income Statement Sales Cost of Sales Gross Profit Operating Expenses (excluding Depreciation Operating Income (EBIT) Interest Income Before

please explain how to get the answer

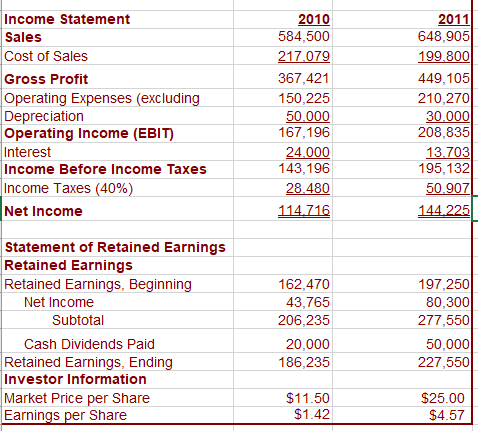

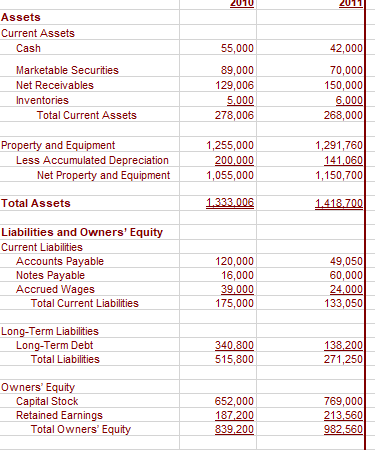

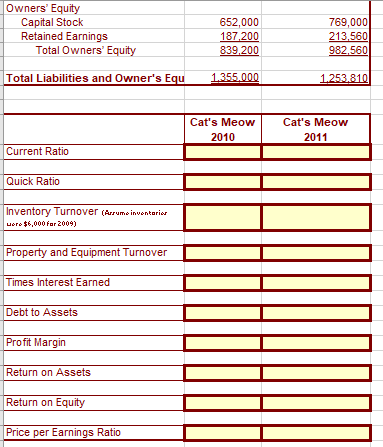

Income Statement Sales Cost of Sales Gross Profit Operating Expenses (excluding Depreciation Operating Income (EBIT) Interest Income Before Income Taxes Income Taxes (40%) Net Income 2010 584,500 217.079 367,421 150,225 50.000 167,196 24.000 143,196 28.480 114.716 2011 648,905 199.800 449,105 210,2701 30.000 208,835 13,703 195,132 50.907 144.225 Statement of Retained Earnings Retained Earnings Retained Earnings, Beginning Net Income Subtotal Cash Dividends Paid Retained Earnings, Ending Investor Information Market Price per Share Earnings per Share 162,470 43,765 206,235 20,000 186,235 197,250 80,300 277,5501 50,000 227,550 $11.50 $1.42 $25.00 $4.57 Assets Current Assets Cash Marketable Securities Net Receivables Inventories Total Current Assets 55,000 89,000 129,006 5.000 278,006 42,000 70,000 150,000 6.000 268,000 Property and Equipment Less Accumulated Depreciation Net Property and Equipment Total Assets 1,255,000 200,000 1,055,000 1,291,760 141.060 1,150,700 1.333.006 1.418.700 Liabilities and Owners' Equity Current Liabilities Accounts Payable Notes Payable Accrued Wages Total Current Liabilities 120,000 16,000 39.000 175,000 49,050 60,000 24,000 133,050 Long-Term Liabilities Long-Term Debt Total Liabilities 340.800 515,800 138,200 271,250 Owners' Equity Capital Stock Retained Earnings Total Owners' Equity 652,000 187,200 839,200 769,000 213.560 982.560 Owners' Equity Capital Stock Retained Earnings Total Owners' Equity 652,000 187,200 839 200 769,000 213.560 982.560 Total Liabilities and Owner's Equ 1.355.000 1.253.810 Cat's Meow 2010 Cat's Meow 2011 Current Ratio Quick Ratio Inventory Turnover (Arrume inventarios uoro $6,000 for 2009) Property and Equipment Turnover Times Interest Earned Debt to Assets Profit Margin Return on Assets Return on Equity Price per Earnings Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts