Question: Please explain how to get the total disbursements answer Question Help X P4-9 (similar to) Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement

Please explain how to get the total disbursements answer

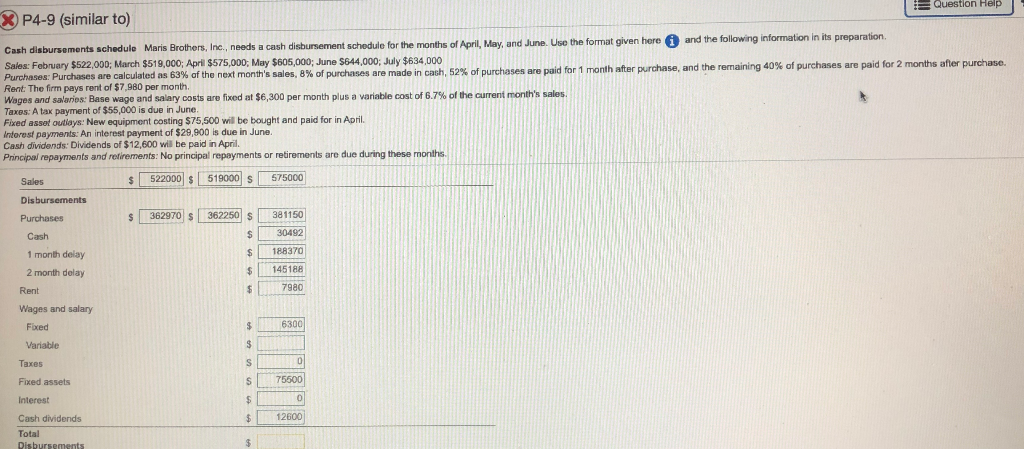

Question Help X P4-9 (similar to) Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May, and June. Use the format given here and the following information in its preparation Sales: February $522,000; March $519,000; April $575,000, May $605,000; June $644,000; July $634,000 Purchases: Purchases are calculated as 63% of the next month's sales, 8% of purchases are made in cash, 52% of purchases are paid for 1 month after purchase, and the remaining 40% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $7,980 per month Wages and salarios: Base wage and salary costs are fixed at $6,300 per month plus a variable cost of 6.7% of the current month's sales. Taxes: A tax payment of $55,000 is due in June Fixed asset outlays: New equipment costing $75,500 will be bought and paid for in April. Interest payments: An interest payment of $29,900 is due in June. Cash dividends: Dividends of $12,600 will be paid in April Principal repayments and retirements: No principal repayments or retirements are due during these months Sales $ 522000 $ 519000 $ 575000 Disbursements $ 362970 S 3622501 s 381150 Purchases Cash 1 month delay $ 30492 $ 188370 2 month delay $ 145188 Rent $ 7980 Wages and salary Fixed Variable $ 6300 S Taxes S 0 Fixed assets S 75500 $ 0 $ 12600 Interest Cash dividends Total Disbursements $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts