Question: please explain how to get this solution using same technique 2. DePressco is anticipating a recession and is expecting negative growth of 4% next year.

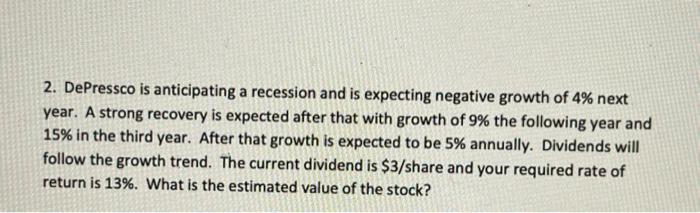

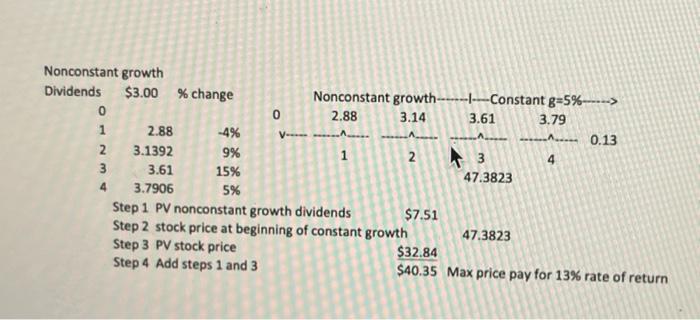

2. DePressco is anticipating a recession and is expecting negative growth of 4% next year. A strong recovery is expected after that with growth of 9% the following year and 15% in the third year. After that growth is expected to be 5% annually. Dividends will follow the growth trend. The current dividend is $3/share and your required rate of return is 13%. What is the estimated value of the stock? 0 2.88 3.14 Nonconstant growth----------- Constant g=5%-----> 3.79 - 0.13 4 3.61 Nonconstant growth Dividends $3.00 % change 0 1 2.88 -4% 2 3.1392 9% 3 3.61 4 3.7906 5% V- 1 2 15% 47.3823 Step 1 PV nonconstant growth dividends $7.51 Step 2 stock price at beginning of constant growth 47.3823 Step 3 PV stock price $32.84 Step 4 Add steps 1 and 3 $40.35 Max price pay for 13% rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts