Question: Please explain how to get those numbers in the journals by show the formula and explain why. Exercise 13.9 REVALUATION OF ASSETS KAS In the

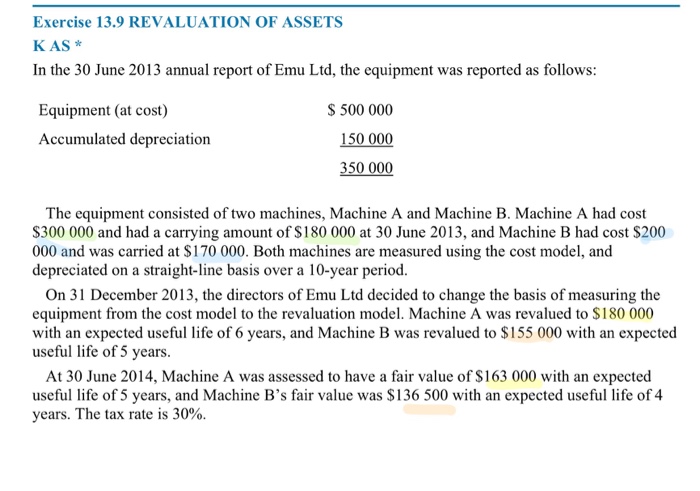

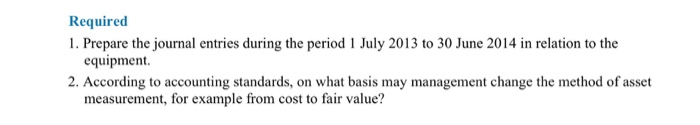

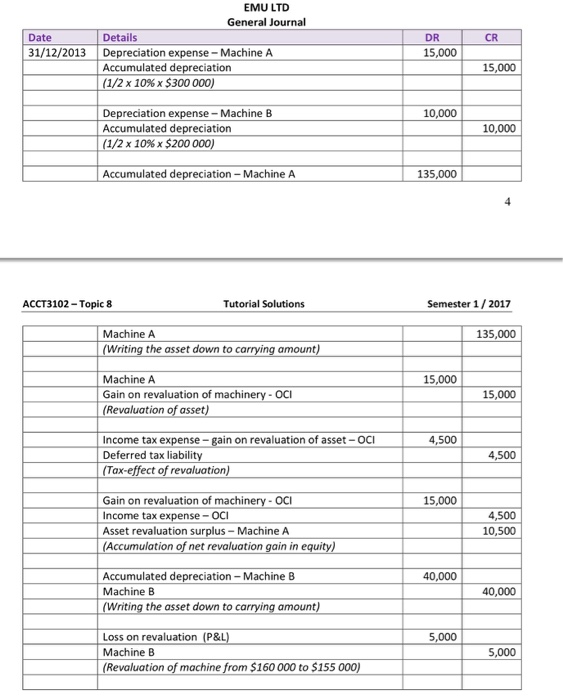

Exercise 13.9 REVALUATION OF ASSETS KAS In the 30 June 2013 annual report of Emu Ltd, the equipment was reported as follows: 500 000 Equipment (at cost) Accumulated depreciation 150 000 350 000 The equipment consisted of two machines, Machine A and Machine B. Machine A had cost S300 000 and had a carrying amount of S180 000 at 30 June 2013, and Machine B had cost $200 000 and was carried at $170 000. Both machines are measured using the cost model, and depreciated on a straight-line basis over a 10-year period. On 31 December 2013, the directors of Emu Ltd decided to change the basis of measuring the equipment from the cost model to the revaluation model. Machine A was revalued to$180 000 with an expected useful life of 6 years, and Machine B was revalued to $155 000 with an expected useful life of 5 years. At 30 June 2014, Machine A was assessed to have a fair value of$163 000 with an expected useful life of 5 years, and Machine B's fair value was $136 500 with an expected useful life of 4 years. The tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts