Question: Please explain how to solve the following exercise: 1) Find the yield curve for September 12, 2023. Compute the one year forward rate for one,

Please explain how to solve the following exercise:

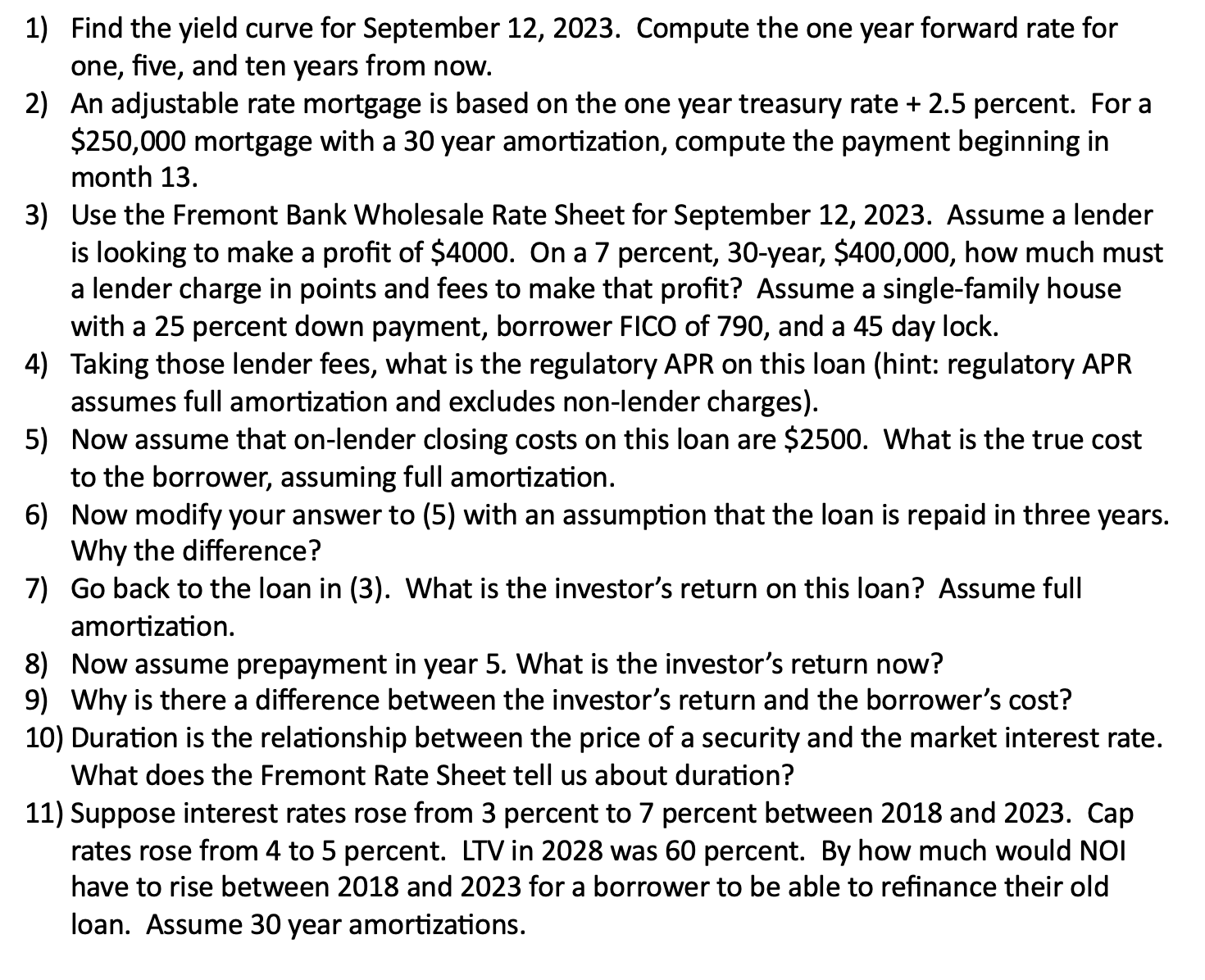

1) Find the yield curve for September 12, 2023. Compute the one year forward rate for one, five, and ten years from now. 2) An adjustable rate mortgage is based on the one year treasury rate +2.5 percent. For a $250,000 mortgage with a 30 year amortization, compute the payment beginning in month 13. 3) Use the Fremont Bank Wholesale Rate Sheet for September 12, 2023. Assume a lender is looking to make a profit of $4000. On a 7 percent, 30-year, $400,000, how much must a lender charge in points and fees to make that profit? Assume a single-family house with a 25 percent down payment, borrower FICO of 790, and a 45 day lock. 4) Taking those lender fees, what is the regulatory APR on this loan (hint: regulatory APR assumes full amortization and excludes non-lender charges). 5) Now assume that on-lender closing costs on this loan are $2500. What is the true cost to the borrower, assuming full amortization. 6) Now modify your answer to (5) with an assumption that the loan is repaid in three years. Why the difference? 7) Go back to the loan in (3). What is the investor's return on this loan? Assume full amortization. 8) Now assume prepayment in year 5 . What is the investor's return now? 9) Why is there a difference between the investor's return and the borrower's cost? 10) Duration is the relationship between the price of a security and the market interest rate. What does the Fremont Rate Sheet tell us about duration? 11) Suppose interest rates rose from 3 percent to 7 percent between 2018 and 2023. Cap rates rose from 4 to 5 percent. LTV in 2028 was 60 percent. By how much would NOI have to rise between 2018 and 2023 for a borrower to be able to refinance their old loan. Assume 30 year amortizations. 1) Find the yield curve for September 12, 2023. Compute the one year forward rate for one, five, and ten years from now. 2) An adjustable rate mortgage is based on the one year treasury rate +2.5 percent. For a $250,000 mortgage with a 30 year amortization, compute the payment beginning in month 13. 3) Use the Fremont Bank Wholesale Rate Sheet for September 12, 2023. Assume a lender is looking to make a profit of $4000. On a 7 percent, 30-year, $400,000, how much must a lender charge in points and fees to make that profit? Assume a single-family house with a 25 percent down payment, borrower FICO of 790, and a 45 day lock. 4) Taking those lender fees, what is the regulatory APR on this loan (hint: regulatory APR assumes full amortization and excludes non-lender charges). 5) Now assume that on-lender closing costs on this loan are $2500. What is the true cost to the borrower, assuming full amortization. 6) Now modify your answer to (5) with an assumption that the loan is repaid in three years. Why the difference? 7) Go back to the loan in (3). What is the investor's return on this loan? Assume full amortization. 8) Now assume prepayment in year 5 . What is the investor's return now? 9) Why is there a difference between the investor's return and the borrower's cost? 10) Duration is the relationship between the price of a security and the market interest rate. What does the Fremont Rate Sheet tell us about duration? 11) Suppose interest rates rose from 3 percent to 7 percent between 2018 and 2023. Cap rates rose from 4 to 5 percent. LTV in 2028 was 60 percent. By how much would NOI have to rise between 2018 and 2023 for a borrower to be able to refinance their old loan. Assume 30 year amortizations

Step by Step Solution

There are 3 Steps involved in it

Sure lets go through each part of the exercise step by step Part 1 Find the yield curve for September 12 2023 Compute the oneyear forward rate for one five and ten years from now To solve this you nee... View full answer

Get step-by-step solutions from verified subject matter experts