Question: please explain how to solve this The Sarah Corp, has the following balance sheet accounts for the years ending December 31 ist. During 2016, Sarah

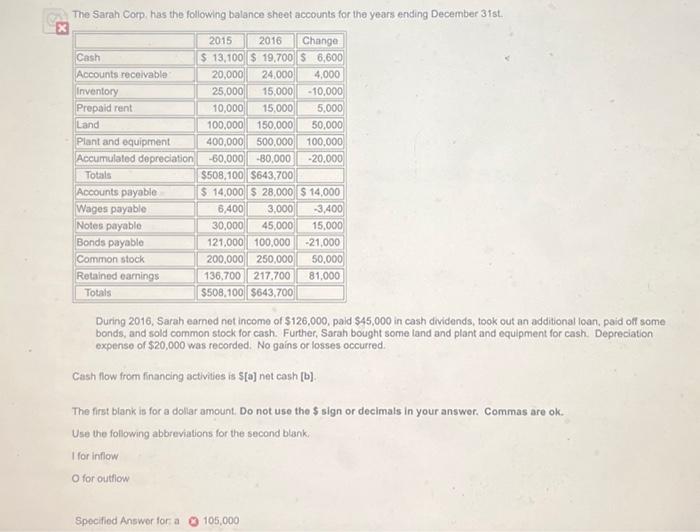

The Sarah Corp, has the following balance sheet accounts for the years ending December 31 ist. During 2016, Sarah earned net income of $126,000, paid $45,000 in cash dividends, took out an additional loan. paid oft some bonds, and sold common stock for cash. Further, Sarah bought some land and plant and equipment for cash. Depreciation expense of $20,000 was recorded. No gains or losses occurred. Cash flow from financing activities is S[a] net cash [b]. The first blank is for a dollar amount. Do not use the $ sign or decimals in your answer. Commas are ok. Use the following abbreviations for the second blank. I for inflow O for outfow Specifind Answor for a o 105,000 The Sarah Corp, has the following balance sheet accounts for the years ending December 31 ist. During 2016, Sarah earned net income of $126,000, paid $45,000 in cash dividends, took out an additional loan. paid oft some bonds, and sold common stock for cash. Further, Sarah bought some land and plant and equipment for cash. Depreciation expense of $20,000 was recorded. No gains or losses occurred. Cash flow from financing activities is S[a] net cash [b]. The first blank is for a dollar amount. Do not use the $ sign or decimals in your answer. Commas are ok. Use the following abbreviations for the second blank. I for inflow O for outfow Specifind Answor for a o 105,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts