Question: Please explain how to solve using a financial calculator. Suppose you can estimate the free cash flow for Hoosier Electronics for the next 3 years.

Please explain how to solve using a financial calculator.

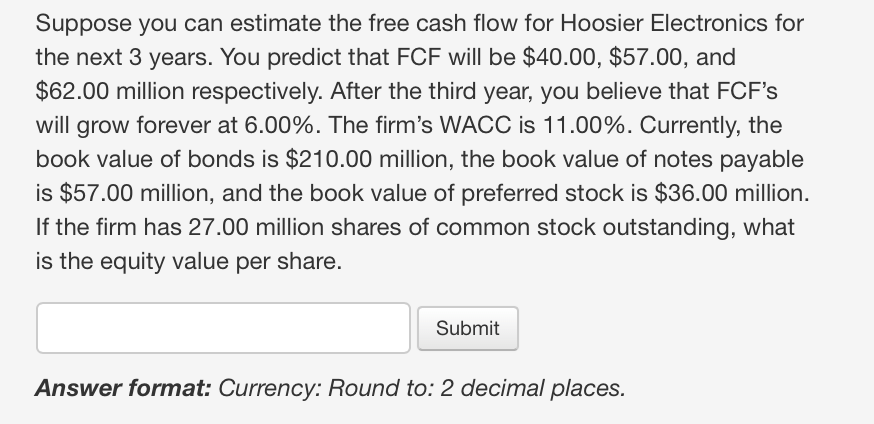

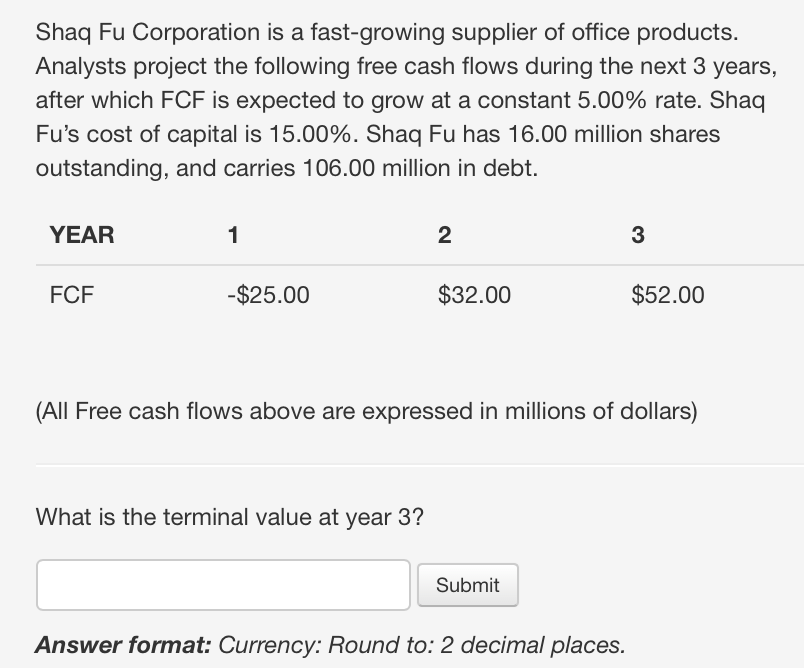

Suppose you can estimate the free cash flow for Hoosier Electronics for the next 3 years. You predict that FCF will be $40.00, $57.00, and $62.00 million respectively. After the third year, you believe that FCF's will grow forever at 6.00%. The firm's WACC is 11.00%. Currently, the book value of bonds is $210.00 million, the book value of notes payable is $57.00 million, and the book value of preferred stock is $36.00 million. If the firm has 27.00 million shares of common stock outstanding, what is the equity value per share. Submit Answer format: Currency: Round to: 2 decimal places. Shaq Fu Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows during the next 3 years, after which FCF is expected to grow at a constant 5.00% rate. Shaq Fu's cost of capital is 15.00%. Shaq Fu has 16.00 million shares outstanding, and carries 106.00 million in debt. YEAR 1 2 3 FCF -$25.00 $32.00 $52.00 (All Free cash flows above are expressed in millions of dollars) What is the terminal value at year 3? Submit Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts