Question: Please explain how to solve using calculator (i.e. TI 84) not Excel. Thank you! Chamberlain Co. wants to issue new 13-year bonds for some much-needed

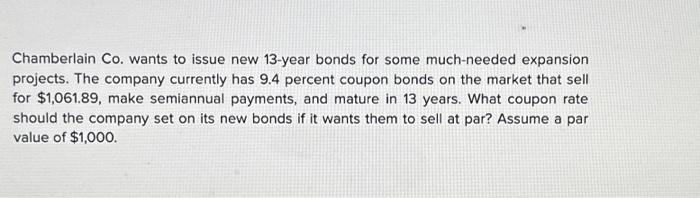

Chamberlain Co. wants to issue new 13-year bonds for some much-needed expansion projects. The company currently has 9.4 percent coupon bonds on the market that sell for $1,061.89, make semiannual payments, and mature in 13 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts