Question: Please explain how to solve with a financial calculator if possible. 6 Both Bond Sam and Bond Dave have 8 percent coupons, make semiannual payments,

Please explain how to solve with a financial calculator if possible.

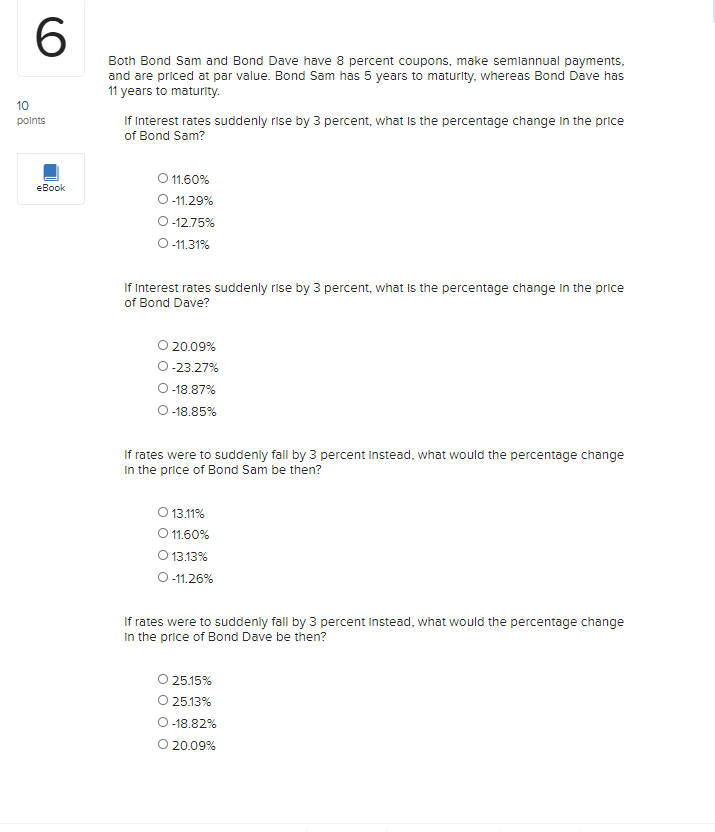

6 Both Bond Sam and Bond Dave have 8 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 5 years to maturity, whereas Bond Dave has 11 years to maturity. If Interest rates suddenly rise by 3 percent, what is the percentage change in the price of Bond Sam? 10 points eBook 11.60% 0 -11.29% 0-12.75% 0-11.31% If Interest rates suddenly rise by 3 percent, what is the percentage change in the price of Bond Dave? 20.09% 0-23.27% O -18.87% 0-18.85% If rates were to suddenly fall by 3 percent Instead, what would the percentage change In the price of Bond Sam be then? 13.11% O 11.60% 13.13% 0-11.26% If rates were to suddenly fall by 3 percent Instead, what would the percentage change In the price of Bond Dave be then? O 25.15% 25.13% -18.82% O 20.09%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts