Question: Please explain how to work this & the process or steps one would take X X incorporate expected inflation rates. Thus, readily available or easily

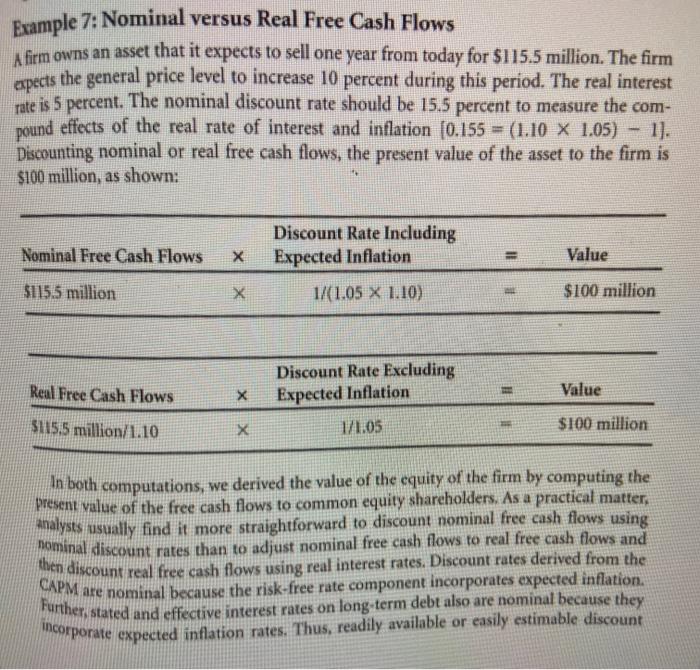

X X incorporate expected inflation rates. Thus, readily available or easily estimable discount Example 7: Nominal versus Real Free Cash Flows A firm owns an asset that it expects to sell one year from today for $115.5 million. The firm expects the general price level to increase 10 percent during this period. The real interest rate is 5 percent. The nominal discount rate should be 15.5 percent to measure the com- pound effects of the real rate of interest and inflation (0.155 = (1.10 X 1.05) - 1). Discounting nominal or real free cash flows, the present value of the asset to the firm is $100 million, as shown: Discount Rate Including Nominal Free Cash Flows Expected Inflation Value $115.5 million 1/(1.05 X 1.10) $100 million Discount Rate Excluding Real Free Cash Flows Expected Inflation Value $115.5 million/1.10 1/1.05 $100 million In both computations, we derived the value of the equity of the firm by computing the present value of the free cash flows to common equity shareholders. As a practical matter, Analysts usually find it more straightforward to discount nominal free cash flows using nominal discount rates than to adjust nominal free cash flows to real free cash flows and thuen discount real free cash flows using real interest rates. Discount rates derived from the CAPM are nominal because the risk-free rate component incorporates expected inflation. Further stated and effective interest rates on long-term debt also are nominal because they X X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts