Question: Please explain how you get the numbers in red. 3. (27 points) On January 1, 2016, Parson Corporation sold equipment to its 70-percent owned subsidiary,

Please explain how you get the numbers in red.

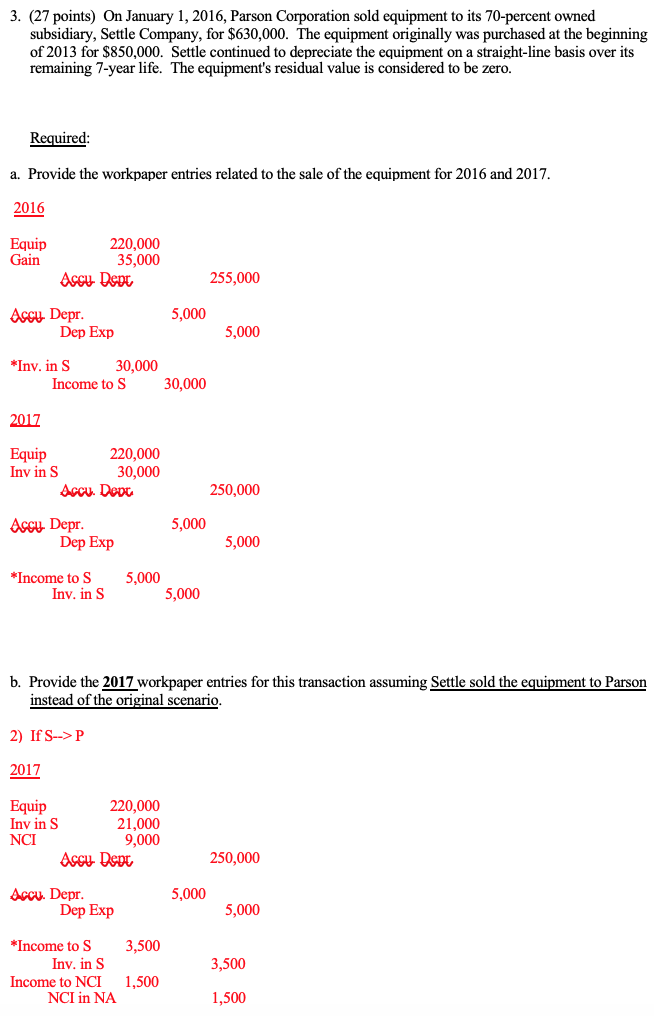

3. (27 points) On January 1, 2016, Parson Corporation sold equipment to its 70-percent owned subsidiary, Settle Company, for $630,000. The equipment originally was purchased at the beginning of 2013 for $850,000. Settle continued to depreciate the equipment on a straight-line basis over its remaining 7-year life. The equipment's residual value is considered to be zero. Required: a. Provide the workpaper entries related to the sale of the equipment for 2016 and 2017. 2016 Equip Gain 220,000 35,000 Accu. Depr 255,000 5,000 Accu Depr. Dep Exp 5,000 *Inv. in s 30,000 Income to S 30,000 2017 Equip 220,000 Inv in s 30,000 Accu. Deoc 250,000 Accu Depr. 5,000 Dep Exp 5,000 *Income to S Inv. in s 5.000 5,000 b. Provide the 2017 workpaper entries for this transaction assuming Settle sold the equipment to Parson instead of the original scenario. 2) If S-->P 2017 Equip 220,000 Inv in s 21,000 NCI 9,000 Accu. Depr 250,000 5,000 Accu. Depr. Dep Exp 5,000 3,500 3,500 *Income to S Inv. in S Income to NCI NCI in NA 1,500 1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts