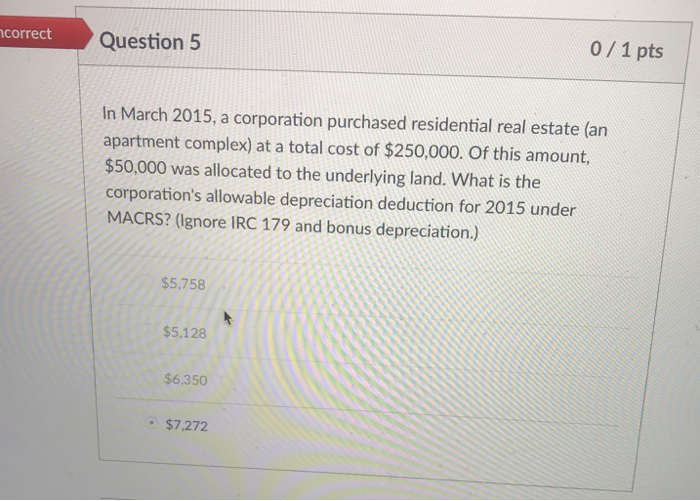

Question: Please explain how you get to the final answer. Thanks! Question 5 0 1 pts correct In March 2015, a corporation purchased residential real estate

Question 5 0 1 pts correct In March 2015, a corporation purchased residential real estate (arn apartment complex) at a total cost of $250,000. Of this amount, $50,000 was allocated to the underlying land. What is the corporation's allowable depreciation deduction for 2015 under MACRS? (Ignore IRC 179 and bonus depreciation.) $5,758 $5,128 $6,350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts